UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to §240.14a-12 |

MARKFORGED HOLDING CORPORATION

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Strengthening Leadership in Additive Manufacturing Nano Dimension’s All-Cash Acquisition of Markforged September 26th, 2024

Forward-Looking Statements and Other Disclaimers This presentation contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar expressions or variations of such words are intended to identify forward-looking statements. Specifically this presentation includes statements regarding: (i) benefits and advantages of the proposed transaction with Markforged Holding Corporation (“Markforged”) and the combined company, (ii) leadership in Additive Manufacturing (“AM”), (iii) future growth, (iv) the combined company’s scale, portfolio, synergies, capital and financial strength, and (v) other aspects of the expected transaction with Markforged, including the timing thereof. Because such statements deal with future events and are based on the current expectations of Nano and Markforged, they are subject to various risks and uncertainties. The acquisition is subject to closing conditions, some of which are beyond the control of Nano Dimension or Markforged. Further, actual results, performance, or achievements of Nano Dimension or Markforged could differ materially from those described in or implied by the statements in this presentation. The forward-looking statements contained or implied in this presentation are subject to other risks and uncertainties, including those discussed (i) under the heading “Risk Factors” in Nano Dimension’s annual report on Form 20-F filed with the Securities and Exchange Commission (“SEC”) on March 21, 2024, and in any subsequent filings with the SEC, and (ii) under the heading “Risk Factors” in Markforged’s annual report on Form 10-K filed with the SEC on March 15, 2024, and in any subsequent filings with the SEC. The combined company financial information included in this presentation has not been audited or reviewed by Nano’s auditors and such information is provided for illustrative purposes only. You should note that such combined company information has not been prepared in accordance with and does not purport to comply with Article 11 of Regulation S-X under the U.S. Securities Act of 1933, as amended (the “Securities Act”). Except as otherwise required by law, each of Nano Dimension and Markforged undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. References and links to websites have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this presentation. Nano Dimension and Markforged are not responsible for the contents of third-party websites.

Forward-Looking Statements and Other Disclaimers (continued) No Offer or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Additional Information about the Markforged Transaction and Where to Find It In connection with the proposed transaction, Markforged intends to file a proxy statement with the SEC. Markforged may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the proxy statement or any other document that Markforged may file with the SEC. The definitive proxy statement (if and when available) will be mailed to shareholders of Markforged. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the proxy statement (if and when available) and other documents containing important information about Markforged and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on Markforged’s website at https://investors.markforged.com/sec-filings. Participants in the Solicitation Nano Dimension, Markforged and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Markforged shareholders in respect of the proposed transaction. Information about the directors and executive officers of Nano Dimension, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Nano Dimension’s Annual Report on Form 20-F for the fiscal year ended December 31, 2023, which was filed with the SEC on March 21, 2024. Information about the directors and executive officers of Markforged, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Markforged’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 26, 2024 and Markforged’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on March 15, 2024. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the proxy statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Nano Dimension or Markforged using the sources indicated above.

Forward-Looking Statements and Other Disclaimers (continued) Additional Information about the Desktop Metal Transaction and Where to Find It In connection with the proposed Desktop Metal, Inc. (“Desktop Metal”) transaction, Desktop Metal filed with the SEC a proxy statement (the “Proxy Statement”) on August 15, 2024. Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the Proxy Statement or any other document that Desktop Metal may file with the SEC. The definitive Proxy Statement has been mailed to shareholders of Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders can obtain free copies of the Proxy Statement and other documents containing important information about Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by the Registrant will be available free of charge on the Registrant’s website at https://investors.nano-di.com/sec-filings-1/default.aspx.

Today’s presenters Yoav Stern CEO & Member of the Board Shai Terem CEO, President, & Member of the Board Along with: From Nano Dimension Zivi Nedivi, President Tomer Pinchas, CFO & COO From Markforged Assaf Zipori

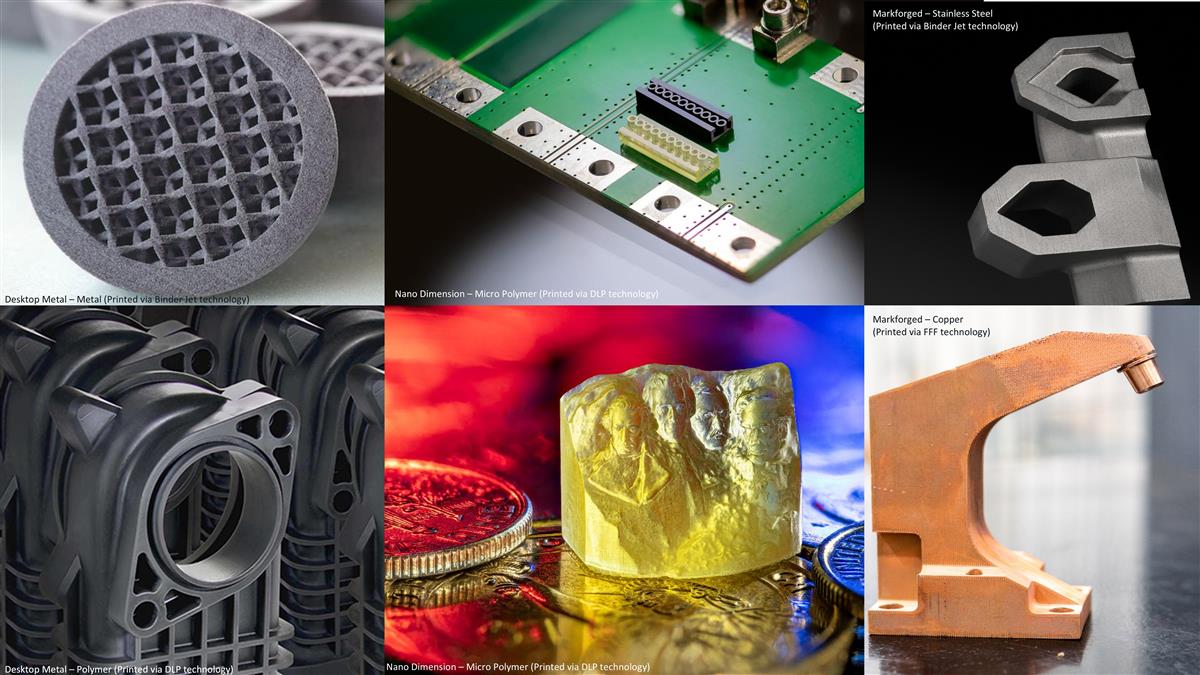

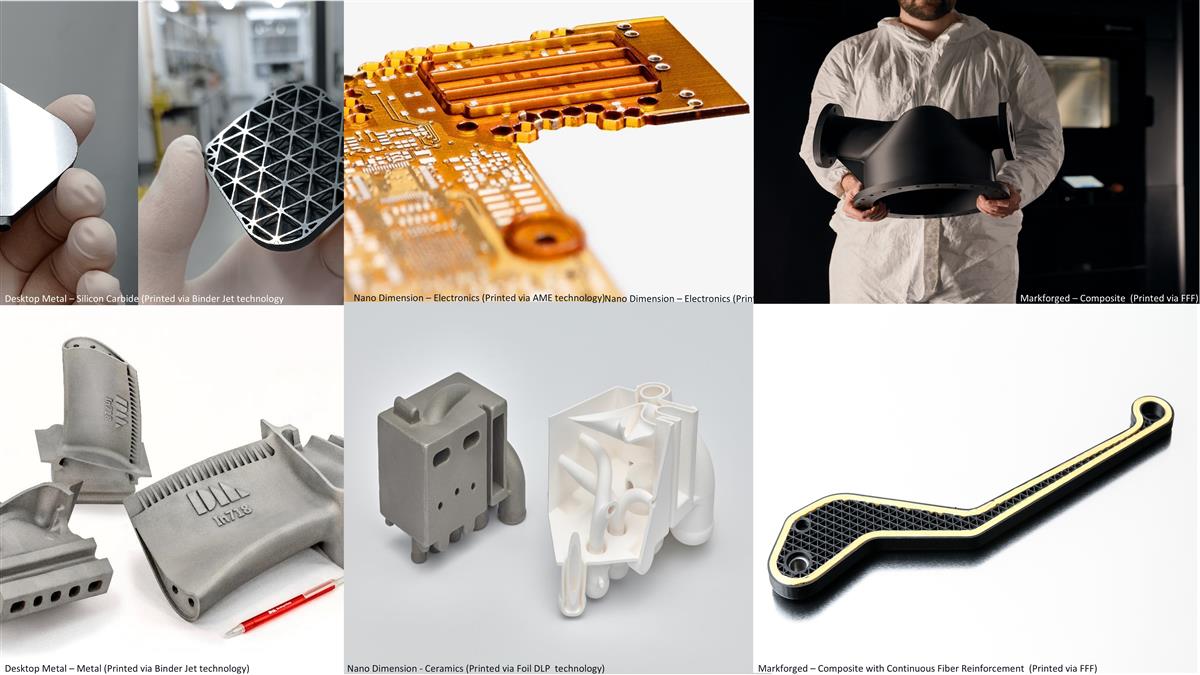

Desktop Metal – Polymer (Printed via DLP technology) Nano Dimension – Micro Polymer (Printed via DLP technology) Nano Dimension – Micro Polymer (Printed via DLP technology) Desktop Metal – Polymer (Printed via DLP technology) Desktop Metal – Metal (Printed via Binder Jet technology) Markforged – Copper (Printed via FFF technology) Markforged – Stainless Steel (Printed via Binder Jet technology)

Nano Dimension - Ceramics (Printed via Foil DLP technology) Nano Dimension – Electronics (Printed via AME technology) Nano Dimension – Electronics (Printed via AME technology) Desktop Metal - Metal Markforged – Composite (Printed via FFF) Markforged – Composite with Continuous Fiber Reinforcement (Printed via FFF) Desktop Metal – Silicon Carbide (Printed via Binder Jet technology Desktop Metal – Metal (Printed via Binder Jet technology)

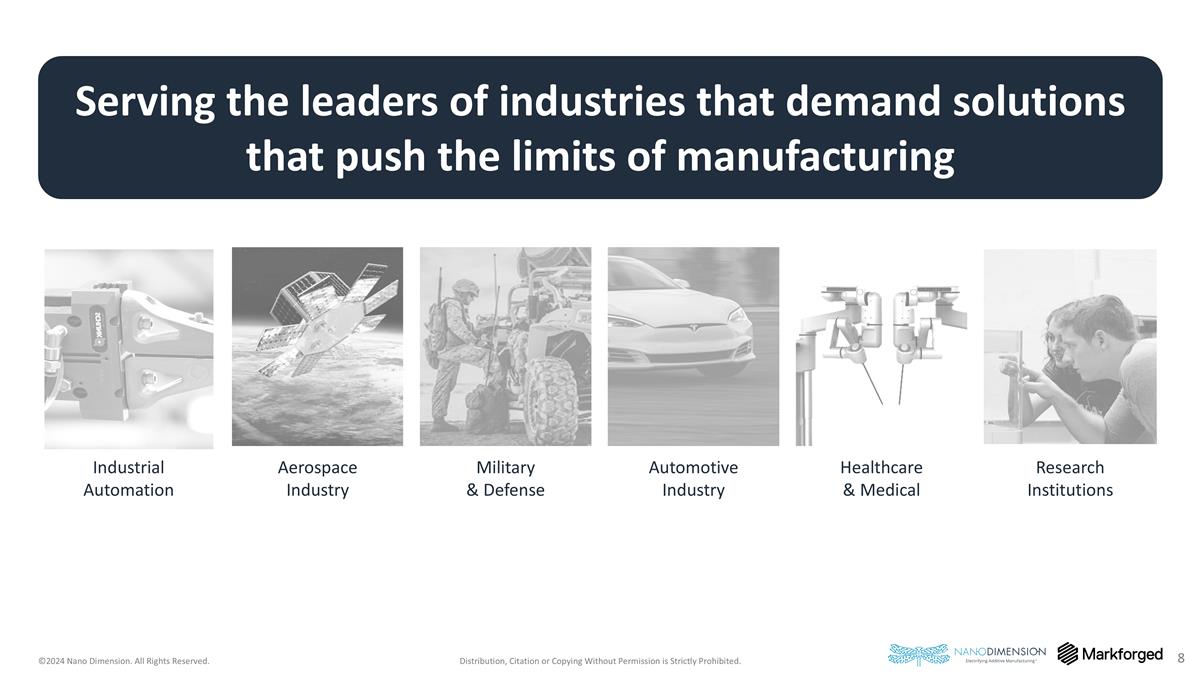

Serving the leaders of industries that demand solutions that push the limits of manufacturing Industrial Automation Automotive Industry Military & Defense Healthcare & Medical Aerospace Industry Research Institutions

Becoming the AM metals – in demand by leading industries – leader for systems for production of metal applications Leveraging organizational scale and a strong balance sheet to lead the industry into profitable growth Strengthening leadership in Additive Manufacturing (“AM”) with the innovative platforms expected to drive future growth Building the most comprehensive portfolio of solutions believed to be the next growth engines of the industry 1 2 Focusing on specialty metal and composite-reinforced materials for high- performance applications with high recurring revenue opportunities 3 4

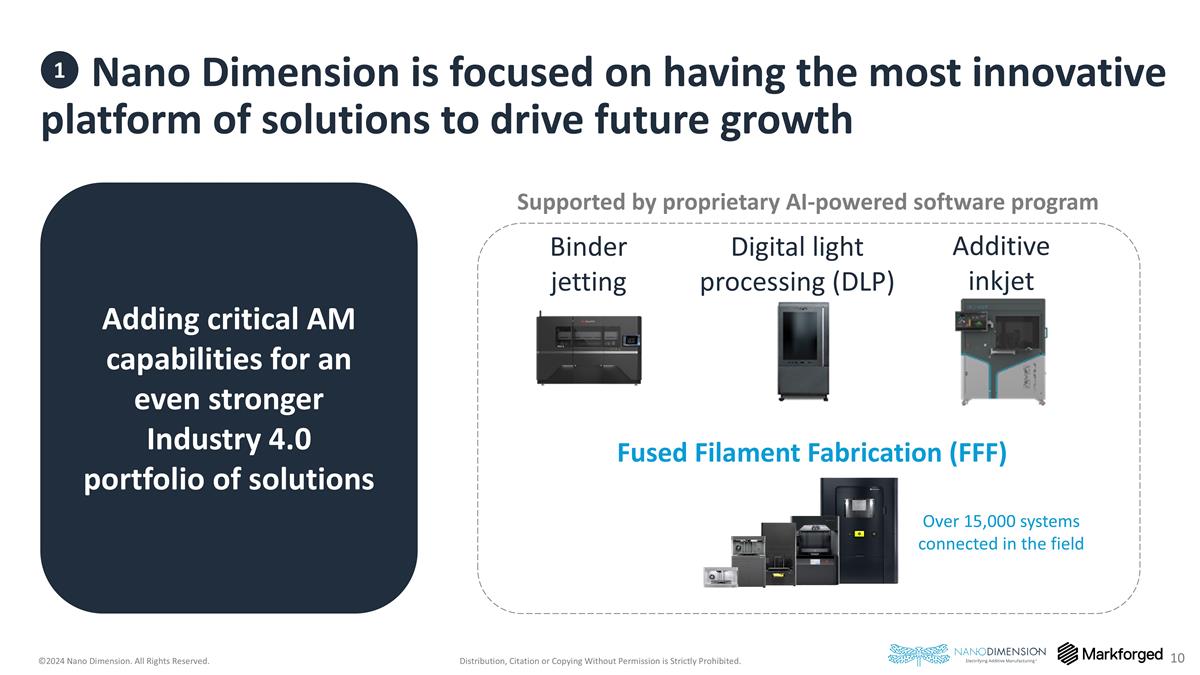

Nano Dimension is focused on having the most innovative platform of solutions to drive future growth Adding critical AM capabilities for an even stronger Industry 4.0 portfolio of solutions Supported by proprietary AI-powered software program Binder jetting Digital light processing (DLP) Additive inkjet Fused Filament Fabrication (FFF) 1 Over 15,000 systems connected in the field

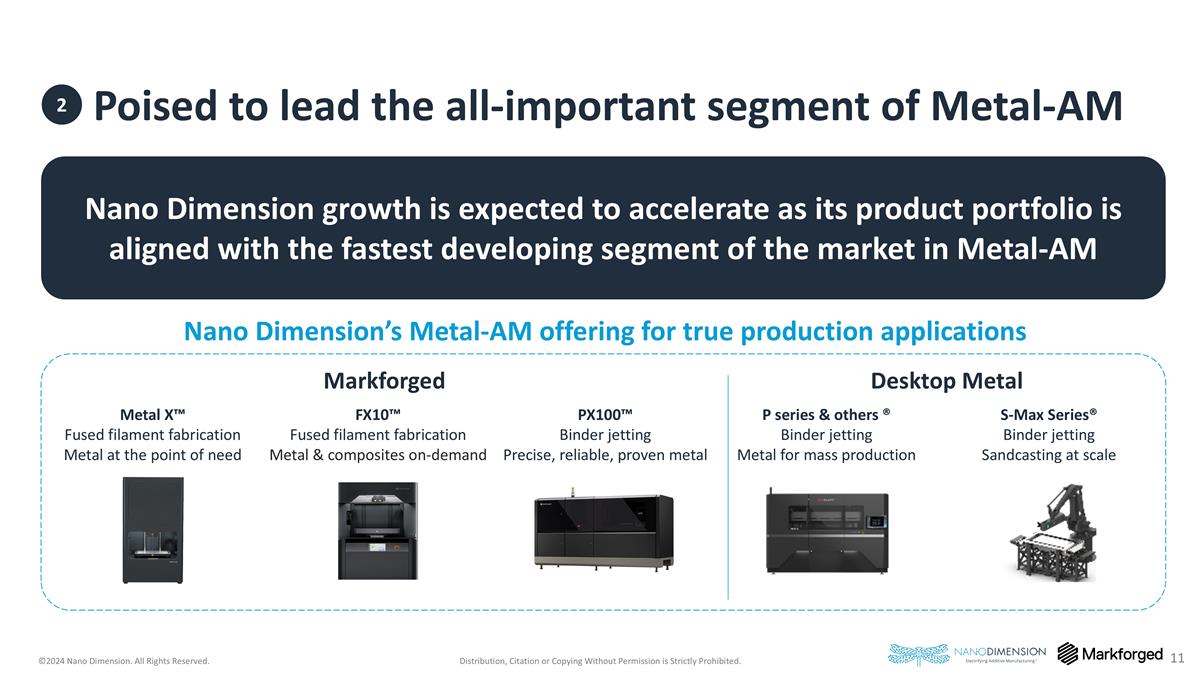

Nano Dimension growth is expected to accelerate as its product portfolio is aligned with the fastest developing segment of the market in Metal-AM Metal X™ Fused filament fabrication Metal at the point of need PX100™ Binder jetting Precise, reliable, proven metal Markforged S-Max Series® Binder jetting Sandcasting at scale P series & others ® Binder jetting Metal for mass production Desktop Metal Nano Dimension’s Metal-AM offering for true production applications FX10™ Fused filament fabrication Metal & composites on-demand Poised to lead the all-important segment of Metal-AM 2

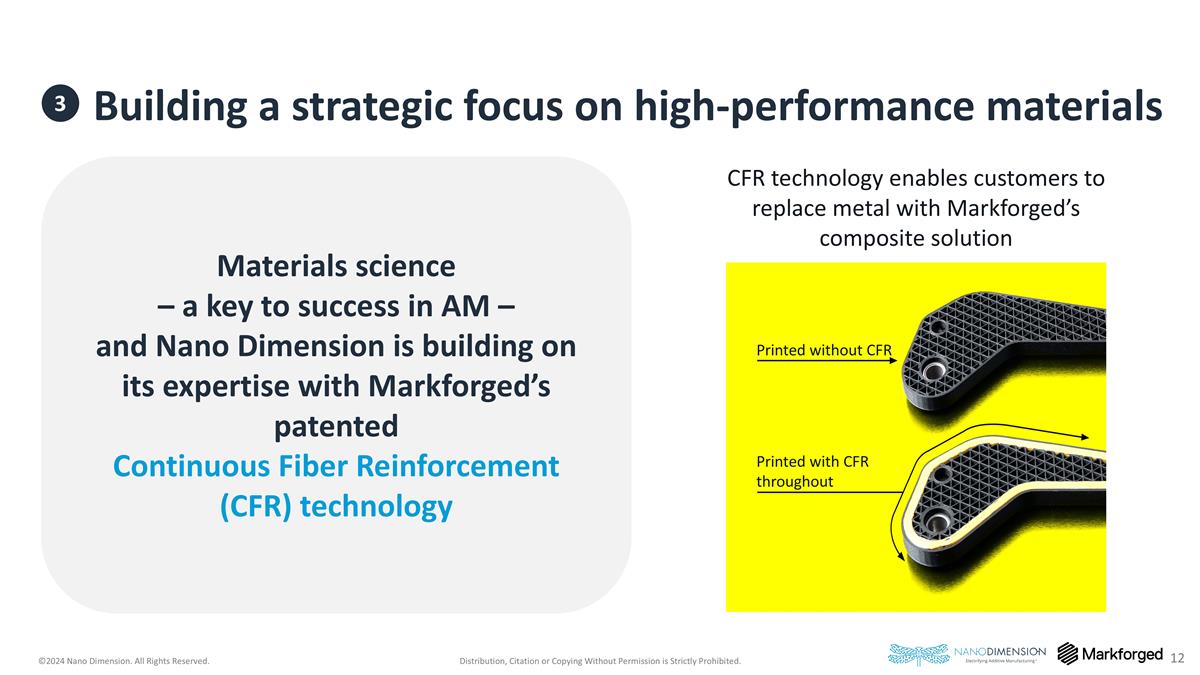

Building a strategic focus on high-performance materials Materials science – a key to success in AM – and Nano Dimension is building on its expertise with Markforged’s patented Continuous Fiber Reinforcement (CFR) technology Printed without CFR Printed with CFR throughout CFR technology enables customers to replace metal with Markforged’s composite solution 3

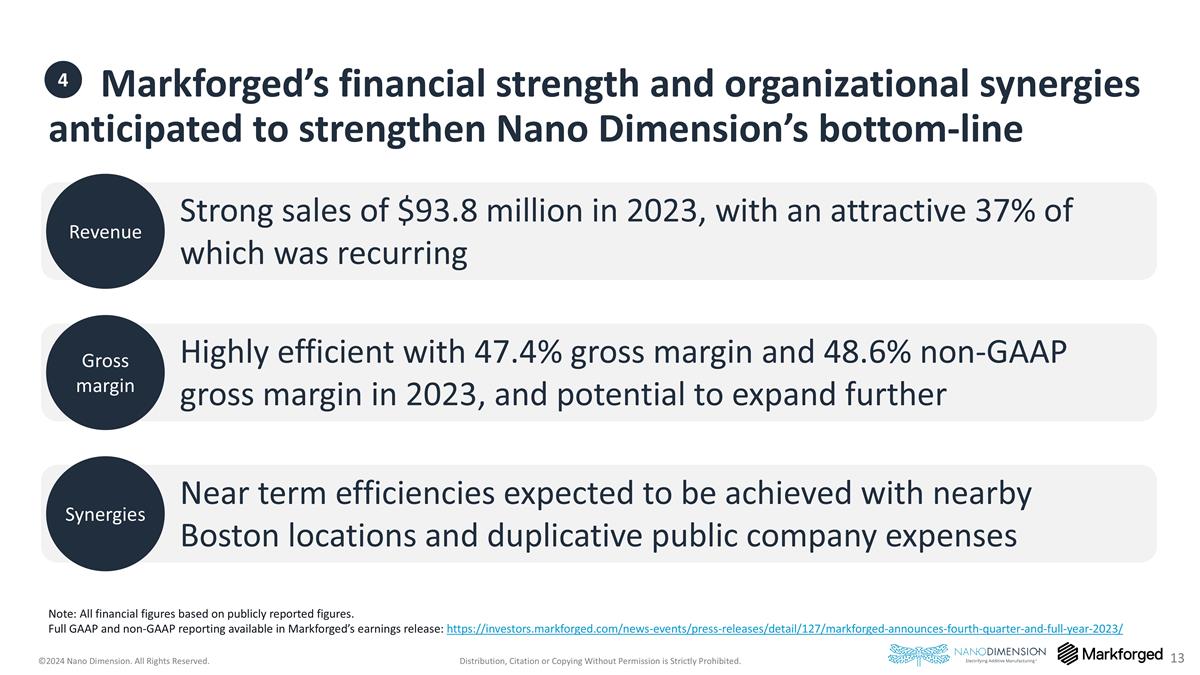

Markforged’s financial strength and organizational synergies anticipated to strengthen Nano Dimension’s bottom-line Note: All financial figures based on publicly reported figures. Full GAAP and non-GAAP reporting available in Markforged’s earnings release: https://investors.markforged.com/news-events/press-releases/detail/127/markforged-announces-fourth-quarter-and-full-year-2023/ Revenue Gross margin Synergies Strong sales of $93.8 million in 2023, with an attractive 37% of which was recurring Highly efficient with 47.4% gross margin and 48.6% non-GAAP gross margin in 2023, and potential to expand further Near term efficiencies expected to be achieved with nearby Boston locations and duplicative public company expenses 4

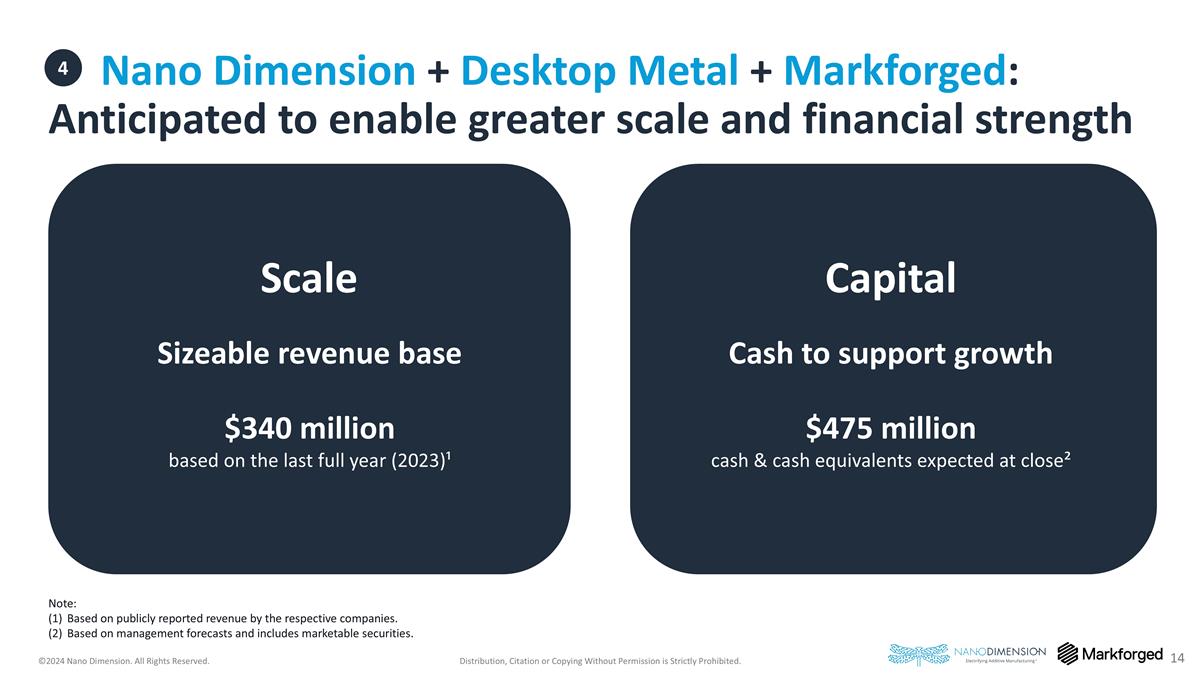

Nano Dimension + Desktop Metal + Markforged: Anticipated to enable greater scale and financial strength Cash to support growth $475 million cash & cash equivalents expected at close² Capital Sizeable revenue base $340 million based on the last full year (2023)¹ Scale Note: Based on publicly reported revenue by the respective companies. Based on management forecasts and includes marketable securities. 4

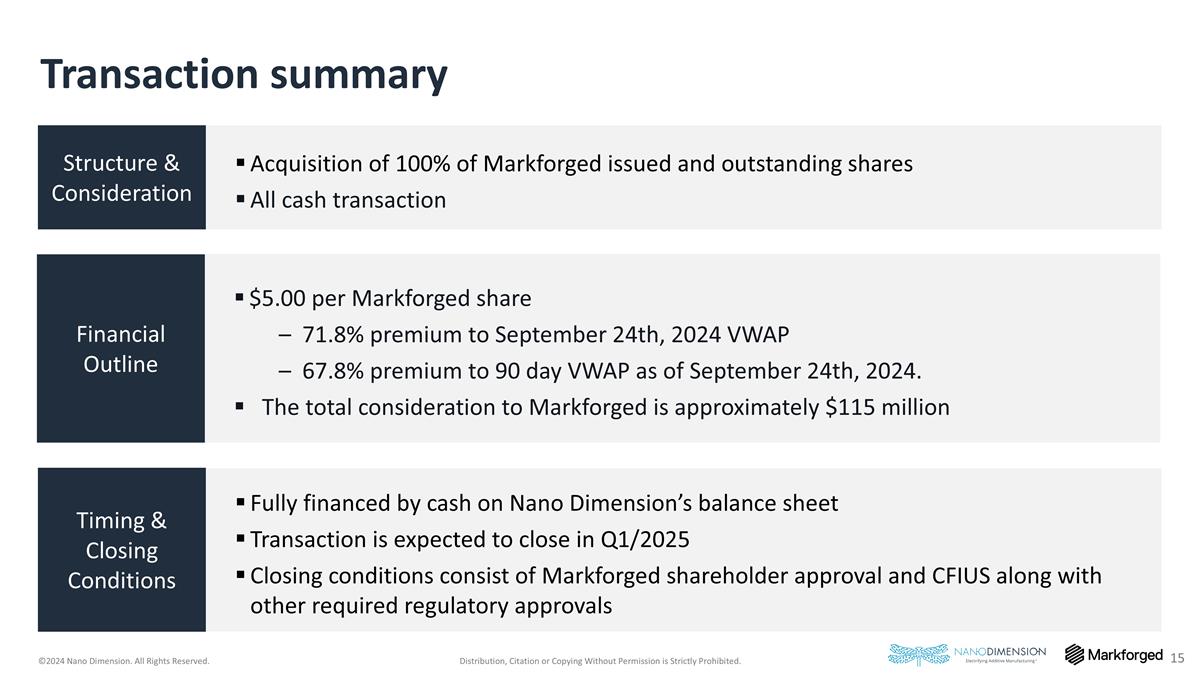

$5.00 per Markforged share 71.8% premium to September 24th, 2024 VWAP 67.8% premium to 90 day VWAP as of September 24th, 2024. The total consideration to Markforged is approximately $115 million Fully financed by cash on Nano Dimension’s balance sheet Transaction is expected to close in Q1/2025 Closing conditions consist of Markforged shareholder approval and CFIUS along with other required regulatory approvals Acquisition of 100% of Markforged issued and outstanding shares All cash transaction Financial Outline Timing & Closing Conditions Structure & Consideration Transaction summary

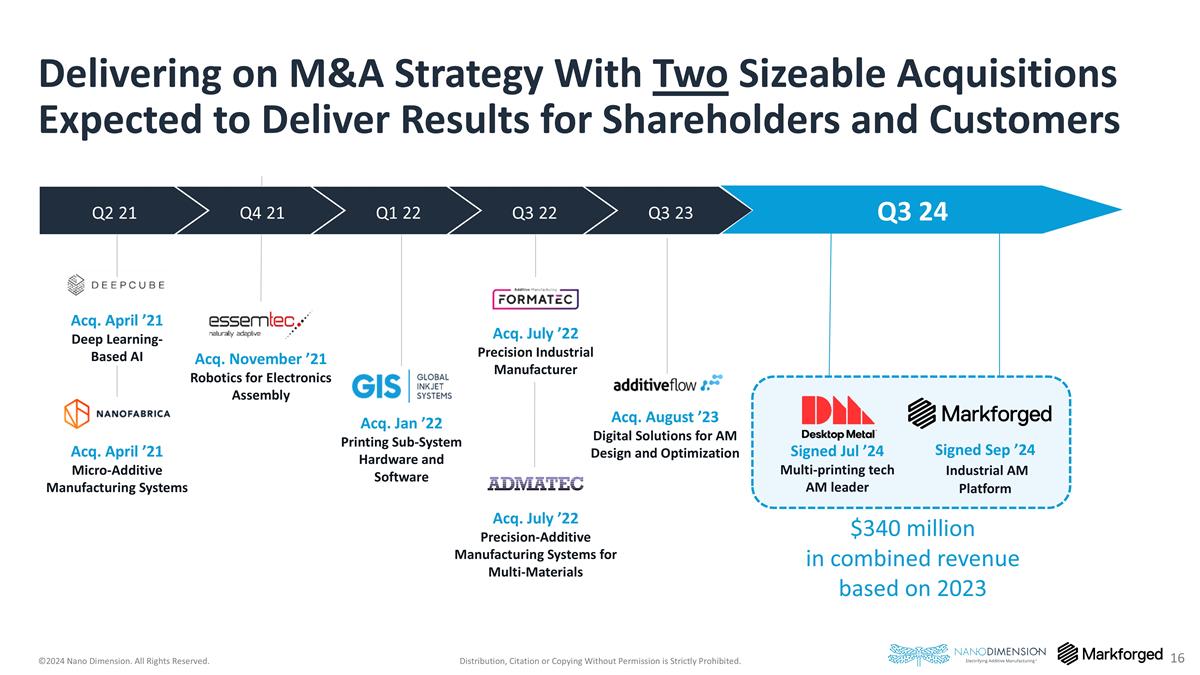

Q3 24 Acq. November ’21 Robotics for Electronics Assembly Acq. July ’22 Precision-Additive Manufacturing Systems for Multi-Materials Acq. Jan ’22 Printing Sub-System Hardware and Software Acq. April ’21 Micro-Additive Manufacturing Systems Acq. July ’22 Precision Industrial Manufacturer Acq. August ’23 Digital Solutions for AM Design and Optimization Acq. April ’21 Deep Learning-Based AI Delivering on M&A Strategy With Two Sizeable Acquisitions Expected to Deliver Results for Shareholders and Customers Q1 22 Q2 21 Q3 23 Q3 22 Q4 21 Signed Jul ’24 Multi-printing tech AM leader Signed Sep ’24 Industrial AM Platform $340 million in combined revenue based on 2023