MARKFORGED HOLDING CORPORATION

480 Pleasant Street, Watertown, Massachusetts 02472

Dear Markforged Stockholder:

I am pleased to invite you to attend the 2022 Annual Meeting of Stockholders, or the Annual Meeting, of Markforged Holding Corporation, or Markforged, to be held online on June 21, 2022, at 9 a.m. Eastern Time. You may attend the meeting virtually via the Internet at www.virtualshareholdermeeting.com/MKFG2022, where you will be able to vote electronically and submit questions. Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2022 Annual Meeting of Stockholders and Proxy Statement.

Pursuant to the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to stockholders over the Internet, we are posting the proxy materials on the Internet and delivering a notice of the Internet availability of the proxy materials. On or about April 29, 2022, we will begin mailing to our stockholders a Notice of Internet Availability of Proxy Materials, or the Notice, containing instructions on how to access online or request a printed copy of our Proxy Statement for the 2022 Annual Meeting of Stockholders and our Annual Report on Form 10-K for the year ended December 31, 2021.

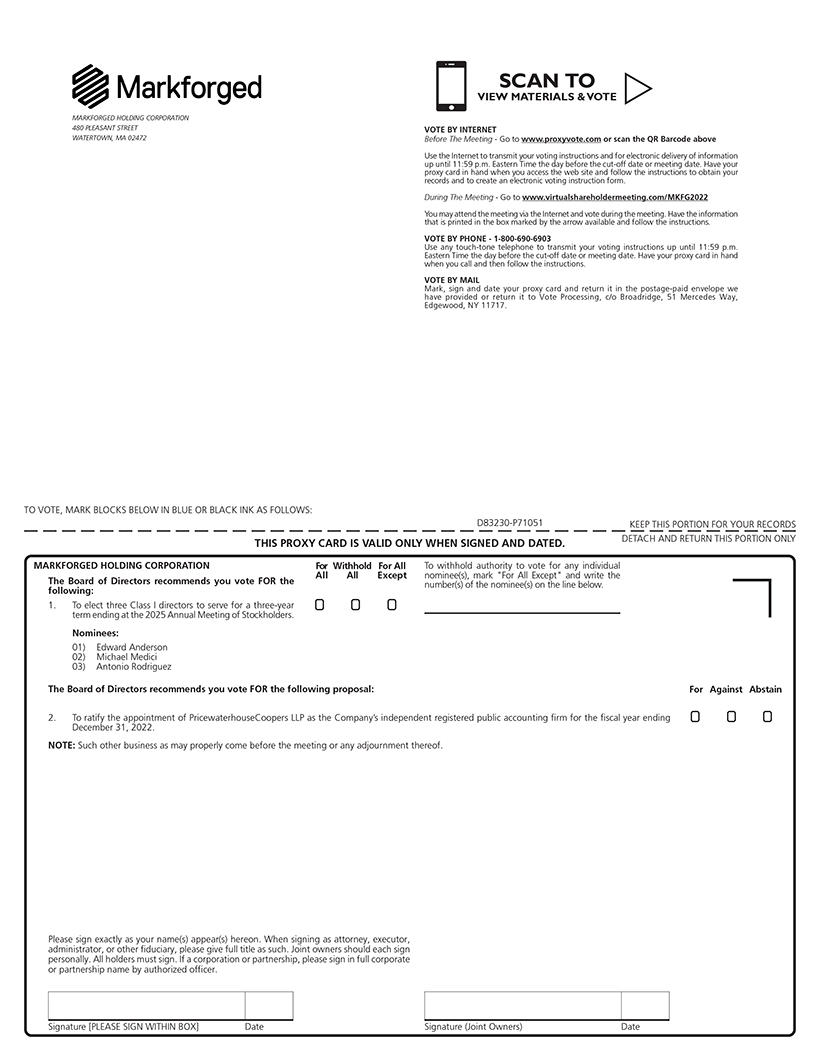

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet, by telephone or virtually in person at the Annual Meeting or, if you requested printed copies of proxy materials, you also may vote by mailing a proxy card. Please review the instructions on the Notice or on the proxy card regarding your voting options.

Thank you for being a Markforged stockholder. We look forward to seeing you at our Annual Meeting.

Sincerely,

/s/ Shai Terem

Shai Terem

Chief Executive Officer