UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

MARKFORGED HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

MARKFORGED HOLDING CORPORATION

60 Tower Road, Waltham, Massachusetts 02451

Dear Markforged Stockholder:

I am pleased to invite you to attend the 2024 Annual Meeting of Stockholders, or the Annual Meeting, of Markforged Holding Corporation, or Markforged, to be held virtually via a live online webcast on June 18, 2024, at 9:00 a.m. Eastern Time. You may attend the meeting virtually via the Internet at www.virtualshareholdermeeting.com/MKFG2024, where you will be able to vote electronically and submit questions. Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

Pursuant to the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to stockholders over the Internet, we are posting the proxy materials on the Internet and delivering a notice of the Internet availability of the proxy materials. On or about April 26, 2024, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials, or the Notice, containing instructions on how to access online or request a printed copy of our Proxy Statement for the 2024 Annual Meeting of Stockholders and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet, by telephone or virtually in person at the Annual Meeting or, if you requested printed copies of proxy materials, you also may vote by mailing a proxy card. Please review the instructions on the Notice or on the proxy card regarding your voting options.

Thank you for being a Markforged stockholder. We look forward to seeing you at our Annual Meeting.

Sincerely,

/s/ Shai Terem

Shai Terem

Chief Executive Officer

April 26, 2024

YOUR VOTE IS IMPORTANT

In order to ensure your representation at the meeting, whether or not you plan to attend the meeting, please vote your shares as promptly as possible by following the instructions on your Notice or, if you requested printed copies of your proxy materials, by following the instructions on your proxy card. Your vote will help to ensure the presence of a quorum at the meeting, meaning that your shares are represented at the Annual Meeting. If you hold your shares through a broker, your broker is not permitted to vote on your behalf on the election of directors or the Officer Exculpation Amendment (as defined below) unless you provide specific instructions to the broker by completing and returning any voting instruction form that the broker provides (or following any instructions that allow you to vote your broker-held shares via telephone or the Internet). For your vote to be counted, you will need to communicate your vote before the date of the Annual Meeting. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy, or voting your stock virtually at the Annual Meeting.

MARKFORGED HOLDING CORPORATION

60 Tower Road, Waltham, Massachusetts 02451

NOTICE OF 2024 VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

To be held June 18, 2024

Notice is hereby given that Markforged Holding Corporation will hold its 2024 Annual Meeting of Stockholders, or the Annual Meeting, virtually via a live online webcast on June 18, 2024 at 9:00 a.m. Eastern Time, for the following purposes:

Our board of directors recommends that you vote “FOR” the director nominees named in Proposal One, “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm as described in Proposal Two, “FOR” the Officer Exculpation Charter Amendment described in Proposal Three, and “FOR” the Reverse Stock Split Charter Amendment described in Proposal Four.

Only stockholders of record at the close of business on April 19, 2024 are entitled to notice of and to vote at the Annual Meeting as set forth in the proxy statement. You may attend, vote and participate at the Annual Meeting by visiting www.virtualshareholdermeeting.com/MKFG2024 and entering the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, on the proxy card, or in the instructions included with the proxy materials dated on or about April 26, 2024. You are entitled to attend the Annual Meeting only if you are a stockholder as of the close of business on April 19, 2024 or hold a valid proxy for the Annual Meeting. If you are a stockholder of record or hold shares through a broker, trustee, or nominee, your ownership as of the record date will be verified prior to admittance into the meeting. Access to the webcast will begin at 8:00 a.m. Eastern Time on June 18, 2024. For instructions on how to vote your shares, please refer to the instructions on the Notice of Availability of Proxy Materials you received in the mail, the section titled “How do I vote?” beginning on page 2 of the proxy statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

By Order of the Board of Directors,

/s/ Stephen Karp

Stephen Karp

General Counsel

Waltham, Massachusetts

April 26, 2024

Table of Contents

|

Page |

|

|

1 |

|

2 |

|

5 |

|

9 |

|

PROPOSAL THREE - APPROVAL OF THE OFFICER EXCULPATION CHARTER AMENDMENT |

11 |

PROPOSAL FOUR - APPROVAL OF THE REVERSE STOCK SPLIT CHARTER AMENDMENT |

13 |

22 |

|

34 |

|

35 |

|

38 |

|

39 |

|

40 |

|

40 |

|

41 |

MARKFORGED HOLDING CORPORATION

60 Tower Road, Waltham, Massachusetts 02451

PROXY STATEMENT

FOR THE 2024 VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 18, 2024

This proxy statement contains information about the 2024 Annual Meeting of Stockholders, or the Annual Meeting, of Markforged Holding Corporation, which will be held virtually via a live online webcast on June 18, 2024, at 9:00 a.m. Eastern Time. You may attend the meeting virtually via the Internet at www.virtualshareholdermeeting.com/MKFG2024, where you will be able to vote electronically and submit questions. The board of directors of Markforged Holding Corporation is using this proxy statement to solicit proxies for use at the Annual Meeting. In this proxy statement, the terms “Company,” “Markforged,” “we,” “us,” and “our” refer to Markforged Holding Corporation and Markforged, Inc, as applicable. The mailing address of our principal executive offices is Markforged Holding Corporation, 60 Tower Road, Waltham, Massachusetts 02451.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our board of directors with respect to each of the matters set forth in the accompanying Notice of Meeting. You may revoke your proxy at any time before it is exercised at the meeting by giving our corporate secretary written notice to that effect. You may also revoke your proxy by attending and casting your vote at the Annual Meeting.

We expect to make this proxy statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2023 available to stockholders on or about April 26, 2024.

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to conform with certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012 (the JOBS Act), including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of: (i) December 31, 2025; (ii) the last day of the fiscal year in which our total annual gross revenue is equal to or more than $1.235 billion; (iii) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission. Even after we are no longer an “emerging growth company,” we may remain a “smaller reporting company.”

Important Notice Regarding the Availability of Proxy Materials for

the 2024 Annual Meeting of Stockholders to be Held on June 18, 2024:

This proxy statement and our 2024 Annual Report to Stockholders are

available for viewing, printing and downloading at www.proxyvote.com.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”), except for exhibits, will be furnished without charge to any stockholder upon written request to Markforged Holding Corporation, 60 Tower Road, Waltham, Massachusetts 02451, Attention: Corporate Secretary or by email to investors@markforged.com. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are also available on the SEC’s website at www.sec.gov.

1

MARKFORGED HOLDING CORPORATION

PROXY STATEMENT

FOR THE 2024 VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

When are this proxy statement and the accompanying materials scheduled to be sent to stockholders?

We have elected to provide access to our proxy materials to our stockholders via the Internet. Accordingly, on or about April 26, 2024, we expect to begin mailing a Notice of Internet Availability of Proxy Materials, or Notice. Our proxy materials, including the Notice of 2024 Annual Meeting of Stockholders, this proxy statement and the accompanying proxy card or, for shares held in street name (i.e., held for your account by a broker or other nominee), a voting instruction form, and the 2024 Annual Report to Stockholders, or 2024 Annual Report, will be mailed or made available to stockholders on the Internet on or about the same date.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, or SEC, for most stockholders, we are providing access to our proxy materials over the Internet rather than printing and mailing our proxy materials. We believe following this process will expedite the receipt of such materials, help lower our costs, and will reduce the environmental impact of our annual meeting materials. Therefore, we expect to mail the Notice to holders of record and beneficial owners of our common stock starting on or about April 26, 2024. The Notice provides instructions as to how stockholders may access and review our proxy materials, including the Notice of 2024 Annual Meeting of Stockholders, this proxy statement, the proxy card and our 2024 Annual Report, on the website referred to in the Notice or, alternatively, how to request that a copy of the proxy materials, including a proxy card, be sent to them by mail. The Notice also provides voting instructions. In addition, stockholders of record may request to receive the proxy materials in printed form by mail or electronically by e-mail on an ongoing basis for future stockholder meetings. Please note that, while our proxy materials are available at the website referenced in the Notice, and our Notice of 2024 Annual Meeting of Stockholders, this proxy statement and our 2024 Annual Report are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this proxy statement.

Who is soliciting my vote?

Our board of directors is soliciting your vote for the Annual Meeting.

When is the record date for the Annual Meeting?

The record date for determination of stockholders entitled to vote at the Annual Meeting will be the close of business on April 19, 2024.

How many votes can be cast by all stockholders?

There were 200,255,278 shares of our common stock, par value $0.0001 per share, outstanding on April 19, 2024, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder of record is entitled to one vote for each share of our common stock held by such stockholder. None of our shares of preferred stock are outstanding as of April 19, 2024.

How do I vote?

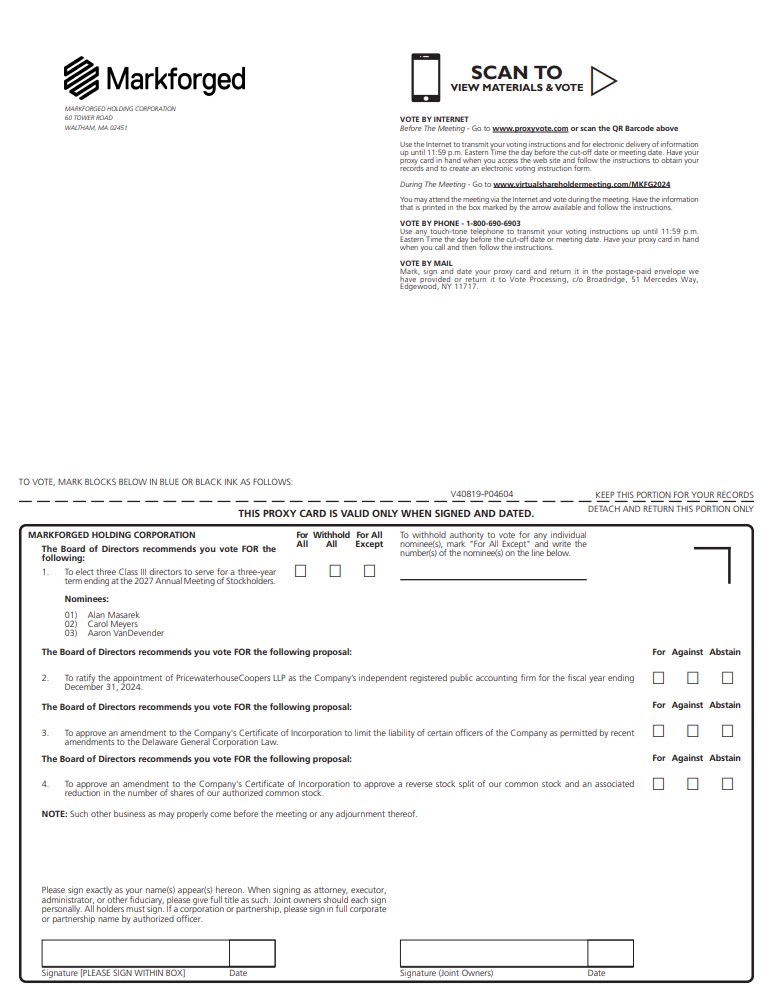

Virtually

If you are a stockholder of record, you may vote by proxy or by attending and voting virtually at the Annual Meeting. You may attend the Annual Meeting virtually via the internet at www.virtualshareholdermeeting.com/MKFG2024 and you may vote during the meeting. Access to the webcast will begin at 8:00 a.m. Eastern Time on June 18, 2024. In order to be able to attend the Annual Meeting, you will need the 16-digit control number, provided in the Notice of Internet Availability of Proxy Materials, on the proxy card, or in the instructions included with the proxy materials dated April 26, 2024. If you hold your shares through a bank or broker and wish to vote in person at the meeting, you must obtain a valid proxy from the firm that holds your shares.

2

By Proxy

If you do not wish to vote virtually or will not be attending the Annual Meeting, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested printed copies of the proxy materials by mail, you can vote by completing and mailing your proxy as described in the proxy materials. In order to be counted, proxies submitted by Internet or phone must be received by the cutoff time of 11:59 p.m. Eastern Time on June 17, 2024. Proxies submitted by mail must be received before the start of the Annual Meeting.

If you complete and submit your proxy before the Annual Meeting, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy without giving voting instructions, your shares will be voted in the manner recommended by the board of directors on all matters presented in this proxy statement, and as the persons named as proxies may determine in their discretion with respect to any other matters properly presented at the Annual Meeting. You may also authorize another person or persons to act for you as proxy in a writing, signed by you or your authorized representative, specifying the details of those proxies’ authority. The original writing must be given to each of the named proxies, although it may be sent to them by electronic transmission if, from that transmission, it can be determined that the transmission was authorized by you.

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in your proxy and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters will be raised at the Annual Meeting.

By Internet or by Phone

You may vote over the internet or by telephone by following the instructions provided on the Notice.

How do I revoke my proxy?

You may revoke your proxy by (1) following the instructions on the Notice and entering a new vote by mail that we receive before the start of the Annual Meeting or over the Internet or by phone by the cutoff time of 11:59 p.m. Eastern Time on June 17, 2024, (2) attending and voting virtually at the Annual Meeting (although attendance at the Annual Meeting will not in and of itself revoke a proxy), or (3) by filing an instrument in writing revoking the proxy or another duly executed proxy bearing a later date with our Corporate Secretary. Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Corporate Secretary or sent to our principal executive offices at Markforged Holding Corporation 60 Tower Road, Waltham, Massachusetts 02451, Attention: Corporate Secretary.

If a broker, bank, or other nominee holds your shares, you must contact such broker, bank, or nominee in order to find out how to change your vote.

How is a quorum reached?

Our bylaws provide that a majority of the outstanding shares entitled to vote, present in person or by remote communication, or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. There were 200,255,278 shares of our common stock outstanding and entitled to vote on the record date. Therefore, a quorum will be present if 100,127,640 shares of our common stock are present in person or represented by executed proxies timely received by us at the Annual Meeting.

Under the General Corporation Law of the State of Delaware, shares that are voted “abstain” or “withheld” and broker “non-votes” are counted as present for purposes of determining whether a quorum is present at the Annual Meeting. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

How is the vote counted?

Under our bylaws, any proposal other than an election of directors is decided by a majority of the votes properly cast for and against such proposal, except where a larger vote is required by law or by our certificate of incorporation or bylaws. Abstentions and broker “non-votes” are not included in the tabulation of the voting results on any such proposal and, therefore, do not have an impact on such proposals. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal

3

because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

If your shares are held in “street name” by a brokerage firm, your brokerage firm is required to vote your shares according to your instructions. If you are a beneficial owner of shares held in a brokerage account and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. Under New York Stock Exchange (“NYSE”) rules, brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under NYSE rules but not with respect to “non-routine” matters. A broker non-vote occurs when a broker, bank or other agent has not received voting instructions from the beneficial owner of the shares and the broker, bank or other agent cannot vote the shares because the matter is considered “non-routine” under NYSE rules. Proposals One and Three are considered to be “non-routine” under NYSE rules such that your broker, bank or other agent may not vote your shares on those proposals in the absence of your voting instructions. Conversely, Proposals Two and Four are considered to be “routine” under NYSE rules and thus if you do not return voting instructions to your broker, your shares may be voted by your broker in its discretion on Proposals Two and Four.

Proposal One: The three nominees who receive the most “for” votes (also known as a “plurality” of the votes cast) will be elected as a director at the Annual Meeting. A nominee must receive at least one “for” vote in order to be elected as a director at the Annual Meeting. Proposal One is considered to be a “non-routine” matter, and a brokerage firm will not be able to vote on this proposal in the absence of instructions from a beneficial owner of shares. Shares voting “withheld” and broker non-votes will have no effect on this proposal.

Proposal Two: The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024 requires the affirmative vote of a majority of the votes properly cast on this proposal. Proposal Two is considered to be a “routine” matter, and a brokerage firm will be able to vote on this proposal even if it does not receive instructions from a beneficial owner of shares. If there are any broker non-votes or abstentions, they will have no effect on this proposal.

Proposal Three: The amendment of our Certificate of Incorporation to limit the liability of certain officers of the Company as permitted by recent amendments to the Delaware General Corporation Law requires the affirmative vote of a majority of the outstanding shares of our capital stock entitled to vote thereon. Proposal Three is considered to be a “non-routine” matter, and a brokerage firm will not be able to vote on this proposal in the absence of instructions from a beneficial owner of shares. Abstentions and broker non-votes will have the same effect as a vote “Against” this proposal.

Proposal Four: The amendment of our Certificate of Incorporation to approve a reverse stock split of our common stock and an associated reduction in the number of shares of our authorized common stock requires the affirmative vote of a majority of the outstanding shares of our capital stock entitled to vote thereon. Proposal Four is considered to be a “routine” matter, and a brokerage firm will be able to vote on this proposal even if it does not receive instructions from a beneficial owner of shares. If there are any broker non-votes or abstentions, they will have the same effect as a vote against this proposal.

Who pays the cost for soliciting proxies?

We are making this solicitation and will pay the entire cost of preparing and distributing the Notice and our proxy materials and soliciting votes. If you choose to access the proxy materials or vote over the Internet, you are responsible for any Internet access charges that you may incur. Our officers and employees may, without compensation other than their regular compensation, solicit proxies through further mailings, personal conversations, facsimile transmissions, e-mails, or otherwise. We have hired Broadridge Financial Solutions, Inc. to assist us in the distribution of proxy materials. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning, and tabulating the proxies.

How can I know the voting results?

We plan to announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting.

4

PROPOSAL ONE - ELECTION OF CLASS III DIRECTORS

Our board of directors currently consists of eight members. In accordance with the terms of our certificate of incorporation and bylaws, our board of directors is divided into three classes, Class I, Class II and Class III, with members of each class serving staggered three-year terms. The members of the classes are divided as follows:

Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Our board of directors has nominated Alan Masarek, Carol Meyers and Aaron VanDevender for election as the Class III directors at the Annual Meeting. The nominees are presently directors and have indicated a willingness to continue to serve as directors, if elected. If the nominees become unable or unwilling to serve, however, the proxies may be voted for a substitute nominee selected by our board of directors.

Nominees for Election as Class III Directors

The following table identifies our directors and sets forth their principal occupation and business experience during the last five years and their ages as of June 1, 2024.

Name |

Positions and Offices Held with Markforged |

Director Since |

Age |

Alan Masarek |

Director and Chairman of the Board of Directors |

2021 |

63 |

Carol Meyers |

Director |

2021 |

63 |

Aaron VanDevender |

Director |

2023 |

44 |

Alan Masarek has served on our board of directors since July 2021. Since August 2022, Mr. Masarek has served as the Chief Executive Officer and a member of the board of directors of Avaya Holdings Corporation. Mr. Masarek previously served as Chief Executive Officer and a member of the board of directors of Vonage (Ticker: VG) from November 2014 to June 2020. Mr. Masarek went to Vonage from Google, Inc., where he was Director, Chrome & Apps from June 2012 until October 2014, following the acquisition of his prior company, Quickoffice, Inc., Mr. Masarek was Co-founder and CEO of Quickoffice, Inc. Mr. Masarek served as a Director of Virtuoso Acquisition Corporation from January 2021 to November 2021, and Director of Wejo Group Limited (Ticker: WEJO) from November 2021 until November 2022. He also serves as chairman of the boards of directors of privately held SalesIntel, Inc. and CircleBack, Inc. Mr. Masarek earned his M.B.A. from Harvard Business School and his B.B.A. from the University of Georgia. We believe Mr. Masarek's extensive industry and board experience makes him well qualified to serve on our board of directors.

Carol Meyers has served on our board of directors since July 2021. In March 2023, Ms. Meyers joined the board of directors of Crunchr, a people analytics software company, where she serves as the chairman of its board of directors. She has served as a director of Rewind Inc., a SaaS back-up and recovery provider since February 2022. Ms. Meyers has served as a venture partner at Glasswing Ventures, LLC, a venture capital firm that invests in artificial intelligence and technology startups, since October 2020. She served as Chief Marketing Officer of Rapid7 (Ticker: RPD), a cybersecurity analytics and automation company, from December 2011 to December 2019, as Senior Vice President and Chief Marketing Officer at LogMeIn, Inc. from 2008 to 2010, and Senior Vice President and Chief Marketing Officer at Unica Corporation from 1999 to 2007. Ms. Meyers served on the boards of directors and audit committees of Zipwhip, Inc., a business-texting software and API provider, from July 2020 to July 2021 when the company was acquired by Twilio, and Hear.com, the world’s largest online provider of medical-grade hearing aids, from April 2021 to July 2022. She served on the board of directors of Emarsys eMarketing Systems AG, a global provider of marketing automation software, from March 2016 to November 2020, when it was acquired by SAP SE. She also served on the board of directors of Mineral Tree, Inc., a provider of accounts payable and payment automation solutions, from July 2014 to March 2019. Ms. Meyers holds a B.S. in finance from Fairfield University and is a graduate of the General Electric Financial Management Program. We believe that Ms. Meyers’ broad operational and board governance experience makes her well qualified to serve on our board of directors.

5

Aaron VanDevender, Ph.D. has served on our board of directors since May 2023. Dr. VanDevender has served as Chief Executive Officer since December 2020 at Methid, Inc., a biotechnology company. Prior to Methid, Dr. VanDevender served as Chief Scientist and Principal from October 2012 to February 2020, and as Chief Scientific Consultant from February 2020 to August 2020 at Founders Fund, LLC, a venture capital firm. From October 2010 to March 2012, Dr. VanDevender served as a physicist at Halcyon Molecular, Inc., a company focused on DNA sequencing technology. From October 2007 to September 2010, he worked as a physicist at the National Institute of Standards and Technology. Dr. VanDevender has served on the board of directors of Emulate, Inc., which creates advanced in vitro human models, since June 2018; on the board of directors of Applied Molecular Transport (Ticker: AMTI), a clinical-stage biopharmaceutical company, from November 2016 to December 2023; and on the board of directors of PsiQuantum, a quantum computer company, since September 2017. Dr. VanDevender holds a B.S. in Physics from the Massachusetts Institute of Technology and a Ph.D. in Physics from the University of Illinois, Urbana-Champaign. We believe Dr. VanDevender's broad operational and board governance experience makes him well qualified to serve on our board of directors.

The proxies will be voted in favor of the above nominees unless a contrary specification is made in the proxy. The nominees have consented to serve as our directors if elected. However, if the nominees are unable to serve or for good cause will not serve as a director, the proxies will be voted for the election of such substitute nominee as our board of directors may designate.

Vote Required

The three nominees who receive the most “for” votes (also known as a “plurality” of the votes cast) will be elected as a director at the Annual Meeting. A nominee must receive at least one “for” vote in order to be elected as a director at the Annual Meeting. Proposal One is considered to be a “non-routine” matter, and a brokerage firm will not be able to vote on this proposal in the absence of instructions from a beneficial owner of shares. Shares voting “withheld” and broker non-votes will have no effect on this proposal.

Board Recommendation

The board of directors recommends voting “FOR” the election of Alan Masarek, Carol Meyers and Aaron VanDevender as the Class III directors, to serve for a three-year term ending at the annual meeting of stockholders to be held in 2027.

6

Directors Continuing in Office

The following table identifies our directors continuing in office and sets forth their principal occupation and business experience during the last five years and their ages as of June 1, 2024.

Name |

Positions and Offices Held with Markforged |

Director Since |

Class and Year in Which Term Will Expire |

Age |

Edward Anderson |

Director |

2021 |

Class I - 2025 |

74 |

Michael Medici |

Director |

2021 |

Class I - 2025 |

45 |

Antonio Rodriguez |

Director |

2021 |

Class I - 2025 |

49 |

Paul Milbury |

Director |

2021 |

Class II - 2026 |

76 |

Shai Terem |

Director, President, and Chief Executive Officer |

2021 |

Class II - 2026 |

46 |

Class I Directors (Term Expires at 2025 Annual Meeting)

Edward Anderson has served on our board of directors since July 2021 and served as a director on the MarkForged, Inc. board of directors from September 2015 until July 2021. Since June 1994, Mr. Anderson has served as the Founder and a Managing Partner of North Bridge Venture Partners, a venture capital firm. Mr. Anderson currently serves on the board of directors of Lyra Therapeutics, Inc. (Ticker: LYRA) and Couchbase, Inc. (Ticker: BASE), and has previously served on the boards of several privately held companies. Mr. Anderson holds a B.F.A. from the University of Denver and an M.B.A. from Columbia University Graduate School of Business. We believe that Mr. Anderson’s extensive experience in venture capital investments qualifies him to serve on our board of directors.

Michael Medici has served as a member of our board of directors since July 2021 and served as a director on the MarkForged, Inc. board of directors from March 2019 until July 2021. Mr. Medici is a Managing Director of Summit Partners, L.P., where he has been employed since March 2005, Mr. Medici currently serves on the board of directors of Klaviyo, Inc. (Ticker: KVYO) and serves or has served as a director of several private companies. Mr. Medici has a B.S. in Finance and International Business from Georgetown University. We believe that Mr. Medici’s extensive financial and industry experience qualify him to serve on our board of directors.

Antonio Rodriguez has served on our board of directors since July 2021 and served as a director of MarkForged, Inc. from May 2014 until July 2021. Mr. Rodriguez is Partner at Matrix Partners, a role he has held since 2010. Prior to joining Matrix Partners, Mr. Rodriguez was Chief Technology Officer of HP Inc.’s Consumer Imaging and Printing Division. In 2005, Mr. Rodriguez co-founded Tabblo, which was sold to HP Inc. in 2007. Mr. Rodriguez holds an A.B. from Harvard University and an M.B.A. from Stanford University. We believe that Mr. Rodriguez’ extensive experience in investments in technology companies qualifies him to serve on our board of directors.

Class II Directors (Term Expires at 2026 Annual Meeting)

Paul Milbury has served on our board of directors since July 2021 and served as a director of MarkForged, Inc. from May 2019 until July 2021. Since May 2010, Mr. Milbury has served on the board of Infinera Corporation (Ticker: INFN), where he is Chair of the Audit Committee. Mr. Milbury was also a Director and Chair of the Audit Committee for Gigamon Inc. (Ticker: GIMO) from January 2014 to December 2017. From July 2011 to March 2017, Mr. Milbury served as Director and Audit Committee Chair of Accedian Networks Inc. From October 2014 to February 2017, Mr. Milbury was Director and Audit Committee Chair of SimpliVity Corporation. Mr. Milbury holds a B.B.A. and an M.B.A. from the University of Massachusetts, Amherst. We believe that Mr. Milbury’s extensive financial expertise qualifies him to serve on our board of directors.

Shai Terem has been our President and Chief Executive Officer and a member of our board of directors since July 2021. Mr. Terem has also served as President, Chief Executive Officer, and director of MarkForged, Inc. from October 2020 until July 2021. Mr. Terem previously served as our President and Chief Operating Officer from December 2019 to October 2020. Prior to that, Mr. Terem was President, Americas at Kornit Digital Ltd. from May 2017 to December 2019. Mr. Terem was VP of Finance & Operations, Americas at Stratasys from January 2015 to April 2017. Mr. Terem served in the Israeli Defense Forces from January 1997 to December 2007, reaching the rank of Lieutenant Commander. He has a B.A. in Economics from Tel Aviv University and an M.B.A. from The University of Chicago – Booth School of Business.

There are no family relationships between or among any of our directors or executive officers. The principal occupation and employment during the past five years of each of our directors was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our directors and any other person or persons pursuant to which he or she is to be selected as a director. There are no

7

material legal proceedings to which any of our directors is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Executive Officers Who Are Not Directors

The following table identifies our executive officers and sets forth their current positions at Markforged and their ages as of June 1, 2024.

Name |

Positions Held with Markforged |

Officer Since |

Age |

Assaf Zipori |

Chief Financial Officer |

2023 |

50 |

Stephen Karp |

General Counsel |

2021 |

49 |

Assaf Zipori has served in the role of Chief Financial Officer since May 2023, including as Acting Chief Financial Officer from May 2023 through March 2024. Mr. Zipori previously served as the Company’s Senior Vice President of Strategy & Corporate Development from April 2021 to May 2023, and the acting Chief Financial Officer of MarkForged, Inc from November 2019 to April 2021. Mr. Zipori has also served as VP, Corporate Development of Yotpo, Inc. from March 2019 to November 2019, and Director of Corporate Development & Ventures – North America of Amdocs Limited from September 2016 to March 2019. Mr. Zipori began his career at Ernst & Young LLP and holds a BBA from Pace University and an MS in Finance from Baruch College.

Stephen Karp has served as our General Counsel since July 2021 and as MarkForged, Inc.’s General Counsel from October 2020 until July 2021. Previously, Mr. Karp served as in-house counsel at Aspen Technology, Inc. from February 2011 through November 2020, most recently as Vice President and Associate General Counsel from October 2019 through November 2020. Prior to Aspen Technology, Inc., Mr. Karp served as Corporate Counsel at Phase Forward Incorporated until the company’s sale to Oracle Corporation in May 2010. Earlier in his career, Mr. Karp served as in-house counsel at IBM and as a corporate associate at the law firm Ropes & Gray LLP. He received a J.D. from Columbia Law School and a B.A. in Political Science and Spanish from Tufts University.

The principal occupation and employment during the past five years of each of our executive officers was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our executive officers and any other person or persons pursuant to which he was or is to be selected as an executive officer. There are no material legal proceedings to which any of our executive officers is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

8

PROPOSAL TWO - RATIFICATION OF THE APPOINTMENT OF

PRICEWATERHOUSECOOPERS LLP

AS MARKFORGED’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE

FISCAL YEAR ENDING DECEMBER 31, 2024

Markforged’s stockholders are being asked to ratify the appointment by the audit committee of the Markforged board of directors of PricewaterhouseCoopers LLP, as Markforged’s independent registered public accounting firm for the fiscal year ending December 31, 2024. PricewaterhouseCoopers LLP has served as independent registered public accounting firm for MarkForged, Inc. since 2019 and for Markforged Holding Corporation since 2021.

The audit committee is solely responsible for selecting Markforged’s independent registered public accounting firm for the fiscal year ending December 31, 2024. Stockholder approval is not required to appoint PricewaterhouseCoopers LLP as Markforged’s independent registered public accounting firm. However, the board of directors believes that submitting the appointment of PricewaterhouseCoopers LLP to the stockholders for ratification is good corporate governance. If the stockholders do not ratify this appointment, the audit committee will reconsider whether to retain PricewaterhouseCoopers LLP. If the selection of PricewaterhouseCoopers LLP is ratified, the audit committee, at its discretion, may direct the appointment of a different independent registered public accounting firm at any time it decides that such a change would be in the best interest of Markforged Holding Corporation and its stockholders.

A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so and to respond to appropriate questions from our stockholders.

Markforged incurred the following fees from PricewaterhouseCoopers LLP for the audit of the consolidated financial statements and for other services provided for the fiscal years ended December 31, 2023 and 2022.

|

|

2023 |

|

|

2022 |

|

||

Audit fees (1) |

|

$ |

1,417,250 |

|

|

$ |

1,640,000 |

|

Audit related fees (2) |

|

|

— |

|

|

|

55,000 |

|

Tax fees (3) |

|

|

54,009 |

|

|

|

577,805 |

|

All other fees |

|

|

2,000 |

|

|

|

4,150 |

|

Total fees |

|

$ |

1,473,259 |

|

|

$ |

2,276,955 |

|

9

Audit Committee Pre-approval Policy and Procedures

Our audit committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by our independent registered public accounting firm. This policy provides that we will not engage our independent registered public accounting firm to render audit or non-audit services unless the service is specifically approved in advance by our audit committee or the engagement is entered into pursuant to the pre-approval procedure described below.

From time to time, our audit committee may pre-approve specified types of services that are expected to be provided to us by our independent registered public accounting firm during the next 12 months. Any such pre-approval details the particular service or type of services to be provided and is also generally subject to a maximum dollar amount.

During our 2023 and 2022 fiscal years, no services were provided to us by PricewaterhouseCoopers LLP other than in accordance with the pre-approval policies and procedures described above.

Vote Required

The approval of Proposal Two, the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024, requires the affirmative vote of a majority of the votes properly cast on this proposal. Proposal Two is considered to be a “routine” matter, and a brokerage firm will be able to vote on this proposal even if it does not receive instructions from a beneficial owner of shares. If there are any broker non-votes or abstentions, they will have no effect on this proposal.

Board Recommendation

The board of directors recommends voting “FOR” Proposal Two to ratify the appointment of PricewaterhouseCoopers LLP as Markforged’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

10

PROPOSAL THREE - AMENDMENT OF EXISTING MARKFORGED HOLDING CORPORATION CHARTER TO PROVIDE EXCULPATORY PROTECTION FOR CERTAIN OFFICERS

General

Effective August 1, 2022, Section 102(b)(7) of the Delaware General Corporation Law (the “DGCL”) was amended to enable a corporation to include in its certificate of incorporation a provision exculpating certain corporate officers from liability in limited circumstances. Previously, Section 102(b)(7) of the DGCL permitted the exculpation of directors only. Amended DGCL Section 102(b)(7) only permits exculpation for direct claims brought by stockholders for breach of an officer’s fiduciary duty of care, including class actions, but does not eliminate officers’ monetary liability for breach of fiduciary duty claims brought by the corporation itself or for derivative claims brought by stockholders in the name of the corporation. Furthermore, the limitation on liability does not apply to breaches of the duty of loyalty, acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, or any transaction in which the officer derived an improper personal benefit.

The board of directors believes it is important to provide protection from certain liabilities and expenses that may discourage prospective or current directors from accepting or continuing membership on corporate boards and prospective or current officers from serving corporations. In the absence of such protection, qualified directors and officers might be deterred from serving as directors or officers due to potential exposure to personal liability and the risk that substantial expense will be incurred in defending lawsuits, regardless of merit. In particular, the board of directors took into account the narrow class and type of claims from which such officers would be exculpated from liability pursuant to amended DGCL Section 102(b)(7), the limited number of our officers that would be impacted, and the benefits the board of directors believes would accrue to the Company by providing exculpation in accordance with DGCL Section 102(b)(7), including, without limitation, the ability to attract and retain key officers and the potential to reduce litigation costs associated with frivolous lawsuits.

The board of directors balanced these considerations with our corporate governance guidelines and practices and determined that it is advisable and in the best interests of us and our stockholders to amend our Certificate of Incorporation (the “Charter”) to adopt amended DGCL Section 102(b)(7) and extend exculpation protection to our officers in addition to our directors in the form attached hereto as Appendix A. We refer to this proposed amendment to our Charter as the “Officer Exculpation Amendment” in this proxy statement.

Text of Proposed Officer Exculpation Amendment

Our Charter currently provides for the exculpation of directors, but does not include a provision that allows for the exculpation of officers. To ensure the Company is able to attract and retain key officers and in an effort to reduce litigation costs associated with frivolous lawsuits, we propose to amend our Charter by adding a new Article X immediately following the existing Article IX thereof as follows:

"ARTICLE X

LIMITATION OF OFFICER LIABILITY

To the fullest extent permitted by the DGCL, an Officer (as defined below) of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of his or her fiduciary duty as an officer of the Corporation, except for liability (a) for any breach of the Officer’s duty of loyalty to the Corporation or its stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) for any transaction from which the Officer derived an improper personal benefit, or (d) arising from any claim brought by or in the right of the Corporation. If the DGCL is amended after the effective date of this Certificate to authorize corporate action further eliminating or limiting the personal liability of Officers, then the liability of an Officer of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended. For purposes of this ARTICLE X, “Officer” shall mean an individual who has been duly appointed as an officer of the Corporation and who, at the time of an act or omission as to which liability is asserted, is deemed to have consented to service of process to the registered agent of the Corporation as contemplated by 10 Del. C. § 3114(b).

Any amendment, repeal or modification of this ARTICLE X by either of (i) the stockholders of the Corporation or (ii) an amendment to the DGCL, shall not adversely affect any right or protection existing at the time of such amendment, repeal or modification with respect to any acts or omissions occurring before such amendment, repeal or modification of a person serving as an Officer at the time of such amendment, repeal or modification.”

The proposed Certificate of Amendment to the Charter reflecting the foregoing Officer Exculpation Amendment is attached as Appendix A to this proxy statement.

Reasons for the Proposed Officer Exculpation Amendment

The board of directors believes it is appropriate for the Company to provide for officer exculpation in its Charter. Our directors and officers are often required to make decisions on crucial matters. Frequently, our directors and officers must make decisions in

11

response to time-sensitive opportunities and challenges, which can create substantial risk of investigations, claims, actions, suits or proceedings seeking to impose liability on the basis of hindsight, especially in the current litigious environment and regardless of merit. Limiting concern about personal risk would empower both our directors and officers to best exercise their business judgment in furtherance of stockholder interests. We expect our peers will continue to adopt exculpation clauses that limit the personal liability of officers in their certificates of incorporation, and failing to adopt the proposed Officer Exculpation Amendment could impact our recruitment and retention of exceptional officer candidates that conclude that the potential exposure to liabilities, costs of litigation defense and other risks of proceedings exceeds the benefits of serving as an officer of the Company.

For the reasons stated above, on March 5, 2024, the board of directors determined that the proposed Officer Exculpation Amendment is advisable and in the best interest of the Company and our stockholders and authorized and approved the proposed Officer Exculpation Amendment and directed that it be considered at the Annual Meeting. The board of directors believes the proposed Officer Exculpation Amendment would better position us to attract top officer candidates and retain our current officers and enable the officers to exercise their business judgment in furtherance of the interests of the stockholders without the potential for distraction posed by the risk of personal liability. Additionally, it would align the protections for our officers with those protections currently afforded to our directors.

The proposed Officer Exculpation Amendment is not being proposed in response to any specific resignation, threat of resignation or refusal to serve by any officer.

Timing and Effect of the Officer Exculpation Amendment

If the proposed Officer Exculpation Amendment is approved by our stockholders, it will become effective immediately upon the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware, which we expect to file promptly after the Annual Meeting. Other than the addition of Article X and the amendments reflected in the Reverse Stock Split Proposal (if adopted by our stockholders), the remainder of our Charter will remain unchanged after effectiveness of the proposed Officer Exculpation Amendment. If the proposed Officer Exculpation Amendment is not approved by our stockholders, our Charter will continue to provide only for the exculpation of our directors. In accordance with the DGCL, the board of directors may elect to abandon the proposed Officer Exculpation Amendment without further action by the stockholders at any time prior to the effectiveness of the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware, notwithstanding stockholder approval of the proposed Officer Exculpation Amendment.

Vote Required for Approval

The approval of Proposal Three, the Officer Exculpation Proposal, requires the affirmative vote of a majority of the outstanding shares of our capital stock entitled to vote thereon. Proposal Three is considered to be a “non-routine” matter, and a brokerage firm will not be able to vote on this proposal in the absence of instructions from a beneficial owner of shares. Abstentions and broker non-votes will have the same effect as a vote “Against” this proposal.

Board Recommendation

The board of directors recommends voting “FOR” Proposal Three to approve and adopt the proposed Officer Exculpation Amendment.

12

PROPOSAL FOUR - REVERSE STOCK SPLIT PROPOSAL

Introduction

Our board of directors has unanimously approved and declared advisable an amendment to our Charter (the “Reverse Stock Split Charter Amendment”), which would effect a reverse stock split of all issued and outstanding shares of our Common Stock (along with any shares of Common Stock held by the Company in treasury), at a ratio ranging from 1-for-5 to 1-for-10, inclusive (the “Reverse Stock Split”), and an associated proportional reduction in the number of shares of Common Stock we are authorized to issue, from 1,000,000,000 to between 100,000,000 and 200,000,000 (the “Authorized Capital Change”), should such Reverse Stock Split Charter Amendment be approved by the stockholders pursuant to this Proposal Four and if the board of directors determines to effect the Reverse Stock Split. The decision whether or not to effect a Reverse Stock Split and the ratio of any Reverse Stock Split will be determined by the board of directors following the Annual Meeting and prior to December 31, 2024. Our board of directors has recommended that the proposed Reverse Stock Split Charter Amendment be presented to our stockholders for approval.

Our stockholders are being asked to approve the Reverse Stock Split and the Authorized Capital Change pursuant to this Proposal Four and to grant authorization to the board of directors to determine, at its option, whether to implement a Reverse Stock Split, including its specific timing and ratio, and the Authorized Capital Change. Should we receive the required stockholder approvals for Proposal Four, the board of directors will have the sole authority to elect, at any time on or prior to December 31, 2024, and without the need for any further action on the part of our stockholders, whether to effect a Reverse Stock Split and the number of whole shares of our Common Stock, between and including 1-for-5 and 1-for-10, that will be combined into one share of our Common Stock (along with the Authorized Capital Change).

By approving Proposal Four, our stockholders will: (a) approve the Reverse Stock Split Charter Amendment pursuant to which any whole number of issued shares of Common Stock between and including 1-for-5 to 1-for-10 as determined by our board of directors, could be combined into one share of Common Stock; (b) approve the Reverse Stock Split Charter Amendment pursuant to which the number of shares of Common Stock we are authorized to issue could be reduced from 1,000,000,000 to between 100,000,000 and 200,000,000, in a manner proportional to the final ratio of the Reverse Stock Split; and (c) authorize the Company to file the Amendment with the Secretary of State of the State of Delaware, in each case as determined by the board of directors at its sole option. The board of directors may also elect not to undertake any Reverse Stock Split and the Authorized Capital Change and therefore abandon the Reverse Stock Split Charter Amendment. No further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split or the Authorized Capital Change. If the Reverse Stock Split Charter Amendment has not been filed with the Secretary of State of the State of Delaware by the close of business on December 31, 2024, our board of directors will abandon the Reverse Stock Split and the Authorized Capital Change, and stockholder approval would again be required prior to implementing a reverse stock split of our Common Stock or reduction of our authorized share capital.

The form of the proposed Reverse Stock Split Charter Amendment to effect the Reverse Stock Split and the Authorized Capital Change is as set forth in Appendix B (subject to the board of directors' selection of the applicable reverse stock split ratio). The Reverse Stock Split, if effected, would affect all of our holders of Common Stock uniformly, except with respect to the treatment of fractional shares. The following description of the proposed Reverse Stock Split Charter Amendment, Reverse Stock Split and Authorized Capital Change is a summary and is subject to the full text of the proposed Reverse Stock Split Charter Amendment.

Background – Reverse Stock Split

On November 17, 2023, we received a letter (the “Letter”) from the NYSE notifying us that we were not in compliance with Rule 802.01C of the NYSE’s Listed Company Manual because the minimum average closing price for our Common Stock had been below $1.00 per share for the previous 30 consecutive trading-day period and therefore no longer complied with the minimum bid price requirement for continued listing on the NYSE. The Letter had no immediate effect on our listing on the NYSE or on the trading of our Common Stock. The Letter provided us with a six-month compliance period, or until May 17, 2024, to regain compliance. We can regain compliance at any time within the six-month compliance period if on the last trading day of any calendar month during the compliance period our Common Stock has a closing share price of at least $1.00 per share and an average closing share price of at least $1.00 per share over the 30 trading-day period ending on the last trading day of that month.

We have been monitoring the closing bid price of the Common Stock, but as of March 28, 2024, the last trading day of the most recent calendar month, the minimum average closing price of the Common Stock has not met the minimum threshold of $1.00 per share for a minimum of 30 consecutive trading days. There can be no assurance that we will regain compliance with the minimum bid price requirement by the end of the six-month compliance period on May 17, 2024 or otherwise maintain compliance with the other NYSE listing requirements.

If we do not meet the minimum bid price requirement by the end of the six-month compliance period, our shares will be subject to

13

delisting by NYSE. If our Common Stock is delisted from NYSE, we may be forced to seek to have our Common Stock traded or quoted on the OTC Bulletin Board or in the “pink sheets.” Such alternatives are generally considered to be less efficient markets and not as broad as NYSE, and therefore less desirable. Accordingly, the delisting, or even the potential delisting, of our Common Stock could have a negative impact on the liquidity and market price of our Common Stock.

As such, our board of directors believes that it is in the best interest of the Company and its stockholders that the board of directors has the ability to effect, in its discretion, the Reverse Stock Split to improve the price level of our Common Stock so that we are able to regain compliance with the minimum bid price requirement and minimize the risk of delisting from NYSE.

Any delisting from NYSE would likely result in further reductions in the market price of our Common Stock, substantially limit the liquidity of our Common Stock, not only in the number of shares that could be bought and sold at a given price, which might be depressed by the relative illiquidity, but also through delays in the timing of transactions and reduction in media and analyst coverage, and materially adversely affect our ability to raise capital or pursue strategic restructuring, refinancing or other transactions on acceptable terms, or at all. Delisting from NYSE could also have other negative results, including the potential loss of institutional investor interest, fewer business development opportunities, and the inability to raise additional required capital. In addition, the SEC has adopted rules governing “penny stocks” that impose additional burdens on broker-dealers trading in stock priced at below $5.00 per share, unless listed on certain securities exchanges. In the event of a delisting, we anticipate taking actions to try to meet NYSE’s initial listing standards and submitting an application for our Common Stock to be listed on NYSE, but we can provide no assurance that any such action taken by us would allow our Common Stock to become listed again, stabilize the market price or improve the liquidity of our Common Stock, prevent our Common Stock from dropping below the minimum bid price requirement or prevent future non-compliance with the NYSE’s listing requirements, whether as to minimum bid price or otherwise.

In addition to regaining compliance with NYSE’s minimum bid price listing requirements, we also believe that the Reverse Stock Split and an increase in our stock price may make our Common Stock more attractive to a broader range of institutional and other investors (including funds that are prohibited from buying stocks whose price is below a certain threshold) and facilitate higher levels of institutional stock ownership, where investment policies generally prohibit investments in lower-priced securities, as well as better enable us to raise funds to help finance operations. We understand that many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers, which reduces the number of potential purchasers of our Common Stock. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically less attractive to brokers. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, we believe the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. Further, lower-priced stocks have a perception in the investment community as being more risky and speculative, which may negatively impact the price of our Common Stock and our market liquidity. If we are successful in maintaining a higher stock price, it may improve the perception of our Common Stock as an investment security.

Background - Authorized Capital Change

As a matter of Delaware law, the implementation of the Reverse Stock Split does not require a reduction in the total number of authorized shares of Common Stock. However, the Amendment will also effect the Authorized Capital Change. The Authorized Capital Change will be proportional to the ratio of the Reverse Stock Split.

As we have disclosed in our other SEC filings, we have a history of operating losses since our inception in 2013 through 2023 and we may continue to incur operating losses and negative cash flow as we continue to invest in research and development efforts, sales and marketing and other aspects of our business. Until such time, if ever, as we can generate positive operating cash flows, we may be required to finance our cash needs through a combination of equity offerings, debt financings, government or other third-party funding, strategic alliances, and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of holders of our Common Stock will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of holders of our Common Stock. There can be no guarantee that we will be successful in raising additional funds in the future through financings, sales of our products, government grants, loans, or from other sources or transactions, and if we are unable to raise such funds, we will exhaust our resources and will be unable to maintain our currently planned operations.

We have no current agreement or commitment to issue additional shares of Common Stock, except for issuances of Common Stock as described below under the heading “Fractional Shares” and upon the exercise or conversion of outstanding stock options, restricted stock units, warrants and other equity securities.

14

Reverse Stock Split

The Reverse Stock Split would affect all stockholders uniformly and would not affect any stockholder’s percentage ownership interest in the Company, except to the extent that the Reverse Stock Split results in any stockholders owning a fractional share, the treatment of which is described below.

Our current authorized share capital is 1,000,000,000 shares of Common Stock, and 100,000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”). As of March 31, 2024, 199,399,503 shares of Common Stock and no shares of Preferred Stock were outstanding. Accordingly, our current authorized but unissued share capital is 800,600,497 shares of Common Stock and 100,000,000 shares of Preferred Stock.

Therefore, as a result of the Reverse Stock Split, the number of outstanding shares of Common Stock would decrease by a specified amount. The number of shares of Common Stock the Company is authorized to issue after the Reverse Stock Split will be adjusted proportionally based on the specific ratio for the Reverse Stock Split. Assuming 199,399,503 shares remain outstanding at the time of the Reverse Stock Split, after giving effect to the Authorized Capital Change and the Reverse Stock Split that would result from the listed hypothetical Reverse Stock Split ratios, without giving effect to the treatment of fractional shares, our authorized but unissued Common Stock, issued and outstanding Common Stock, and Common Stock reserved for future issuance under our equity and benefit plans, issuable upon exercise of outstanding options or the release of restricted stock units would be as follows:

|

Pre-Reverse Split |

|

1-for-5 (1) |

|

1-for-6 |

|

1-for-7 |

|

1-for-8 |

|

1-for-9 |

|

1-for-10 |

|

|||||||

Authorized (2) |

|

1,000,000,000 |

|

|

200,000,000 |

|

|

166,666,667 |

|

|

142,857,143 |

|

|

125,000,000 |

|

|

111,111,111 |

|

|

100,000,000 |

|

Outstanding |

|

199,399,503 |

|

|

39,879,901 |

|

|

33,233,251 |

|

|

28,485,643 |

|

|

24,924,938 |

|

|

22,155,500 |

|

|

19,939,950 |

|

Reserved for future issuance pursuant |

|

48,350,038 |

|

|

9,670,008 |

|

|

8,058,340 |

|

|

6,907,148 |

|

|

6,043,755 |

|

|

5,372,226 |

|

|

4,835,004 |

|

Number of shares issuable upon exercise of |

|

10,756,575 |

|

|

2,151,315 |

|

|

1,792,763 |

|

|

1,536,654 |

|

|

1,344,572 |

|

|

1,195,175 |

|

|

1,075,658 |

|

Number of shares issuable upon release of |

|

13,717,905 |

|

|

2,743,581 |

|

|

2,286,318 |

|

|

1,959,701 |

|

|

1,714,738 |

|

|

1,524,212 |

|

|

1,371,791 |

|

Authorized but unissued and unreserved |

|

727,775,979 |

|

|

145,555,196 |

|

|

121,295,997 |

|

|

103,967,997 |

|

|

90,971,997 |

|

|

80,863,998 |

|

|

72,777,598 |

|

The actual number of shares outstanding after giving effect to the Reverse Stock Split, if implemented, will depend on the reverse stock split ratio that is ultimately determined by the board of directors. No shares of our Preferred Stock are outstanding and the total number of authorized shares of Preferred Stock will not be affected by the Reverse Stock Split.

The Reverse Stock Split would not change the par value of the Common Stock. If any stockholder would otherwise receive a fractional share of Common Stock as a result of the Reverse Stock Split, our board of directors will issue an additional fraction of a share of Common Stock to such holder, which fraction, when combined with the fraction resulting from the Reverse Stock Split, will equal a whole share of Common Stock, such that no holder will continue to hold fractional shares following the Reverse Stock Split.

Criteria to be Used for Determining Reverse Stock Split Ratio

The purpose of a range for the Reverse Stock Split is to give the board of directors the flexibility to meet business needs as they arise, to take advantage of favorable opportunities and to respond to a changing investment environment, such as stock price fluctuations, higher inflation, higher interest rates and related factors. In determining which reverse stock split ratio to implement, if any, following receipt of stockholder approval of the Amendment to effect the Reverse Stock Split, the board of directors may consider, among other things, various factors, such as:

15

Our board of directors reserves the right to abandon the Reverse Stock Split and the Authorized Capital Change without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of the State of Delaware of the Reverse Stock Split Charter Amendment, even if the authority to effect a Reverse Stock Split has been approved by our stockholders at the Annual Meeting. If the Reverse Stock Split Proposal is approved, we could effect the Reverse Stock Split and the Authorized Capital Change at any time after the Annual Meeting until December 31, 2024. By voting in favor of the Reverse Stock Split Proposal, you are expressly also authorizing the board of directors to delay, not to proceed with, and abandon, the Reverse Stock Split and the Authorized Capital Change if it should so decide, in its sole discretion, that such action is in the best interests of the stockholders.

Effectiveness of Reverse Stock Split and Authorized Capital Change

The Reverse Stock Split and Authorized Capital Change would become effective at the effective time set forth in the Reverse Stock Split Charter Amendment (the “Effective Time”).

Procedure for Implementing the Reverse Stock Split and Authorized Capital Change

If Proposal Four is approved by our stockholders, our board of directors retains the discretion to effect the Reverse Stock Split and the Authorized Capital Change at any time prior to December 31, 2024 or not at all. Our board of directors will determine whether such an action is in the best interests of the Company and our stockholders, taking into consideration the factors discussed above and any other factors it considers relevant. The Reverse Stock Split and the Authorized Capital Change would be implemented by filing the Reverse Stock Split Charter Amendment with the Secretary of the State of Delaware, setting forth the ratio used in the Reverse Stock Split.

If the Reverse Stock Split is effected, then after the Effective Time, our Common Stock will have a new Committee on Uniform Securities Identification Procedures (“CUSIP”) number, which is a number used to identify our equity securities. Our Common Stock will continue to be listed on NYSE under the symbol “MKFG” subject to any future change of listing of our securities. Stockholders that hold their shares electronically in book-entry form with our transfer agent, Continental Stock Transfer & Trust Company, do not have stock certificates evidencing their ownership of Common Stock or warrants. They are, however, provided with a statement reflecting the number of shares registered in their accounts. If a stockholder holds registered shares in book-entry form with our transfer agent, no action is needed to receive post-Reverse Stock Split shares. If a stockholder is entitled to post-Reverse Stock Split shares, a transaction statement will automatically be sent to the stockholder's address of record indicating the number of shares of Common Stock or warrants held following the Reverse Stock Split.

Principal Effects of the Reverse Stock Split Charter Amendment

Reverse Stock Split – General

The Reverse Stock Split, if implemented by the board of directors, will reduce the total number of outstanding shares of Common Stock based on the split ratio determined by the board of directors in its discretion, and it will apply automatically to all shares of our Common Stock, including shares held by the Company in treasury, shares issuable upon the exercise or conversion of outstanding stock options, restricted stock units, warrants and other equity securities. The Reverse Stock Split would be effected simultaneously for all shares of our Common Stock, and the split ratio would be the same for all shares of Common Stock. The Reverse Stock Split would affect all of our stockholders uniformly and would not affect any stockholder’s percentage ownership interests in the Company, except with respect to the treatment of fractional shares. The principal effect of the Reverse Stock Split will be to proportionately decrease the number of outstanding shares of our Common Stock based on the split ratio selected by our board of directors.

16

Voting rights and other rights of the holders of our Common Stock will not be affected by the Reverse Stock Split, other than as a result of the treatment of fractional shares. The number of stockholders of record will not be affected by the Reverse Stock Split. If approved and implemented, the Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of our Common Stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally higher than the costs of transactions in “round lots” of even multiples of 100 shares. Our board of directors believes, however, that these potential effects are outweighed by the benefits of the Reverse Stock Split.

Our Common Stock is currently registered under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and we are subject to the periodic reporting and other requirements of the Exchange Act. After the Reverse Stock Split, we will continue to be subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split would not affect our securities law reporting and disclosure obligations, and we would continue to be subject to the periodic reporting requirements of the Exchange Act.

You are urged to consult your own tax advisors to determine the tax consequences to you of the Reverse Stock Split.

Under Delaware law, our stockholders will not be entitled to exercise dissenter’s or appraisal rights with respect to the Reverse Stock Split, and the Company will not independently provide stockholders with any such rights.

Authorized Shares; Number of Shares of Common Stock Available for Future Issuance

The Reverse Stock Split will result in a reduction of the total outstanding shares of Common Stock and shares reserved for issuance under outstanding stock options, restricted stock units, warrants and other equity securities. The Authorized Capital Change will result in a reduction in the number of our authorized Common Stock proportional to the ratio of the Reverse Stock Split. The number of our authorized Common Stock available for future issuance will decrease as a result of the Authorized Capital Change, but the number of our authorized Common Stock available for future issuance as a percentage of our total authorized Common Stock will stay the same, subject to adjustment described under the heading “Fractional Shares”.

Except for a stock split or stock dividend, future issuances of shares of our Common Stock will dilute the voting power and ownership of our existing stockholders and, depending on the amount of consideration received in connection with the issuance, could also reduce stockholders’ equity on a per share basis. If the board of directors authorizes the issuance of additional shares after the Reverse Stock Split, the dilution to the ownership interest of our existing stockholders may be greater than would have occurred had the Reverse Stock Split not been effected. We have no current agreement or commitment to issue additional shares of Common Stock, except for issuances of Common Stock as described below under the heading “Fractional Shares” and upon the exercise or conversion of outstanding stock options, restricted stock units, warrants and other equity securities.

Effect of the Reverse Stock Split on Employee Plans, Stock Options, Restricted Stock Units, Warrants and Other Equity Securities