1 Agenda Introduction - 12:00pm HQ Product Tour - 12:10pm The Inflection Point - 1:15pm Customer Panel - 1:30pm Digital Source Introduction - 2:40pm Digital Source Customer Panel - 3:05pm Financial Update - 3:40pm Q & A - 3:45pm Welcome Investors!

2 Disclaimer Forward-Looking Statements. This presentation (the “Presentation”) contains forward-looking statements that are based on beliefs and assumptions and on information currently available. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “strategy,”“anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “opportunity” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although Markforged believes that it has a reasonable basis for each forward-looking statement contained in this Presentation, Markforged cautions you that these statements are based on a combination of facts and factors currently known by it and its projections of the future, about which it cannot be certain. Forward-looking statements in this Presentation include, but are not limited to,future growth rate, revenue, gross profit margin and earnings guidance; timing for achieving profitability; our ability to fulfill orders for our products in a timely fashion in the future; expected growth, the size of and opportunity to increase our addressable market; the anticipated benefits of the acquisition of Teton Simulation and Digital Metal, the timing of the launches of and the rate and extent of adoption of our products, including, but not limited to, our most recently introduced products; market trends in the manufacturing industry; the effects of macroeconomic factors;and the benefits to consumers, functionality and applications of Markforged’s products. Markforged cannot assure you that the forward-looking statements in this Presentation will prove to be accurate. These forward looking statements are subject to a number of risks and uncertainties, including, among others, general economic, political and business conditions; the ability of Markforged to maintain its listing on the New York Stock Exchange; the effect of COVID-19 on Markforged’s business and financial results; the outcome of any legal proceedings against Markforged; and those factors discussed under the header “Risk Factors” in Markforged’s most recent periodic and other filings with the SEC.Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that Markforged will achieve its objectives and plans in any specified time frame, or at all. The forward-looking statements in this Presentation represent Markforged’s views as of the date of this Presentation. Markforged anticipates that subsequent events and developments will cause its views to change. However, while Markforged may elect to update these forward-looking statements at some point in the future, Markforged has no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing Markforged’s views as of any date subsequent to the date of this Presentation. Market and Industry Data. Certain information contained in this Presentation relates to or is based on publications, surveys and the Company’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its internal research is reliable, such research has not been verified by any independent source. Use of Non-GAAP Financial Metrics. This Presentation includes the non-GAAP financial measures of non-GAAP gross profit margin, and guidance for non-GAAP financial measures of non-GAAP gross margin, non-GAAP operating loss and non-GAAP earnings per share. These non-GAAP measures are an addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of historical non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Markforged believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Markforged. Markforged’s management uses forward-looking non-GAAP measures to evaluate Markforged’s projected financials and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures, including that they exclude significant expenses that are required by GAAP to be recorded in Markforged’s financial measures. In addition, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Markforged’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

3 Safe Harbor Statement Management will be making statements during this event that include estimates and other forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements contained in this event that are not statements of historical facts should be deemed to be forward-looking statements. These statements represent management’s views as of today, September 19th, 2023 and are subject to material risks and uncertainties that could cause actual results to differ materially. Markforged disclaims any intention or obligation, except as required by law, to update or revise forward-looking statements. Also during the course of today's event, we refer to certain non-GAAP financial measures. There is a reconciliation schedule showing the GAAP versus non-GAAP in the appendix of this presentation.

03 The Inflection Point Shai Terem, CEO Markforged 4

5 The World Has Changed Supply Chain Disruptions Sustainable Manufacturing Market & Geopolitical Instability

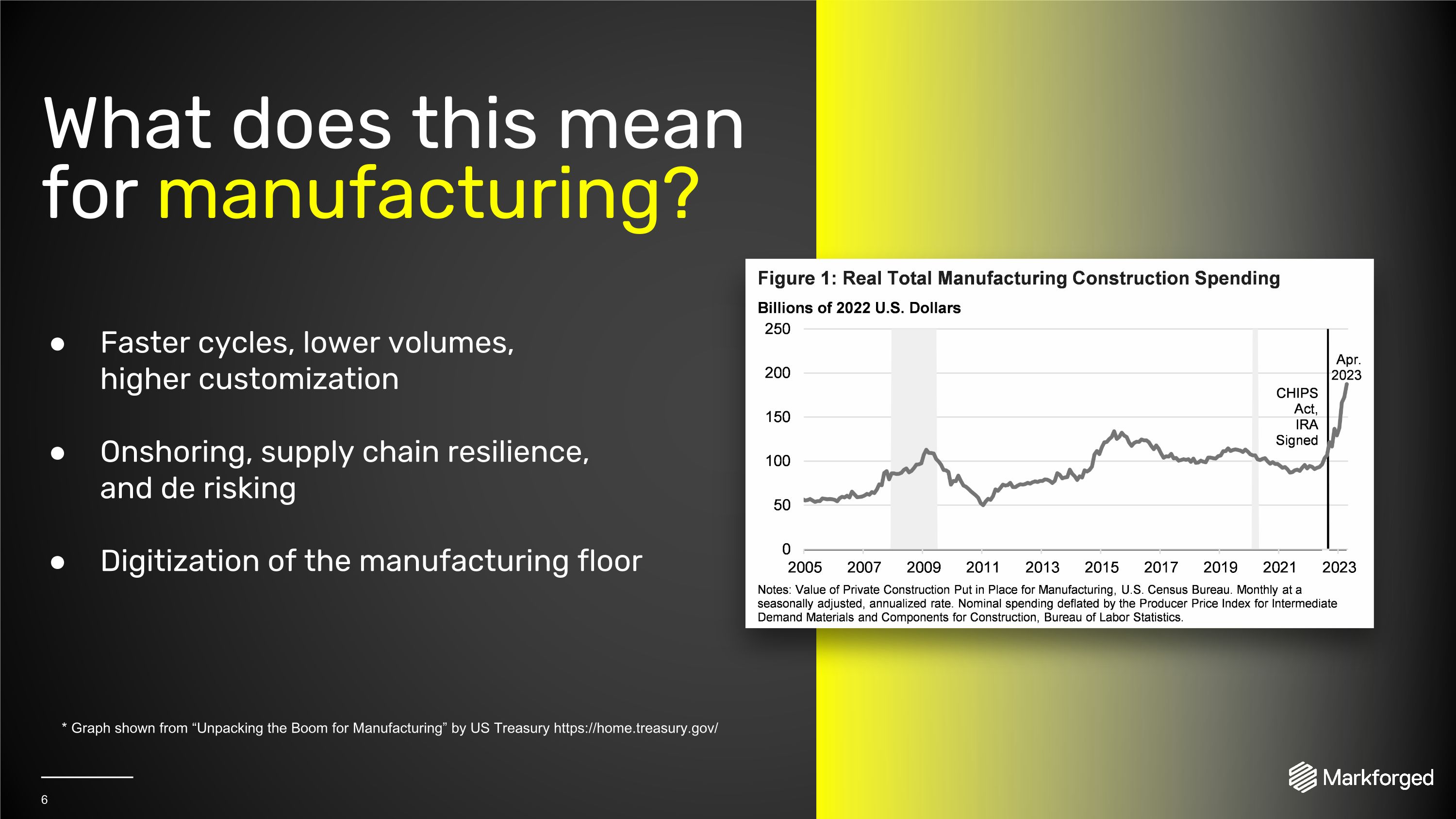

6 What does this mean for manufacturing? Faster cycles, lower volumes, higher customization Onshoring, supply chain resilience, and de risking Digitization of the manufacturing floor * Graph shown from “Unpacking the Boom for Manufacturing” by US Treasury https://home.treasury.gov/

7 Driving accelerated adoption of additive manufacturing into production to build resilient and flexible supply chains. The Inflection Point is Here.

8 The work starts on the factory floor.

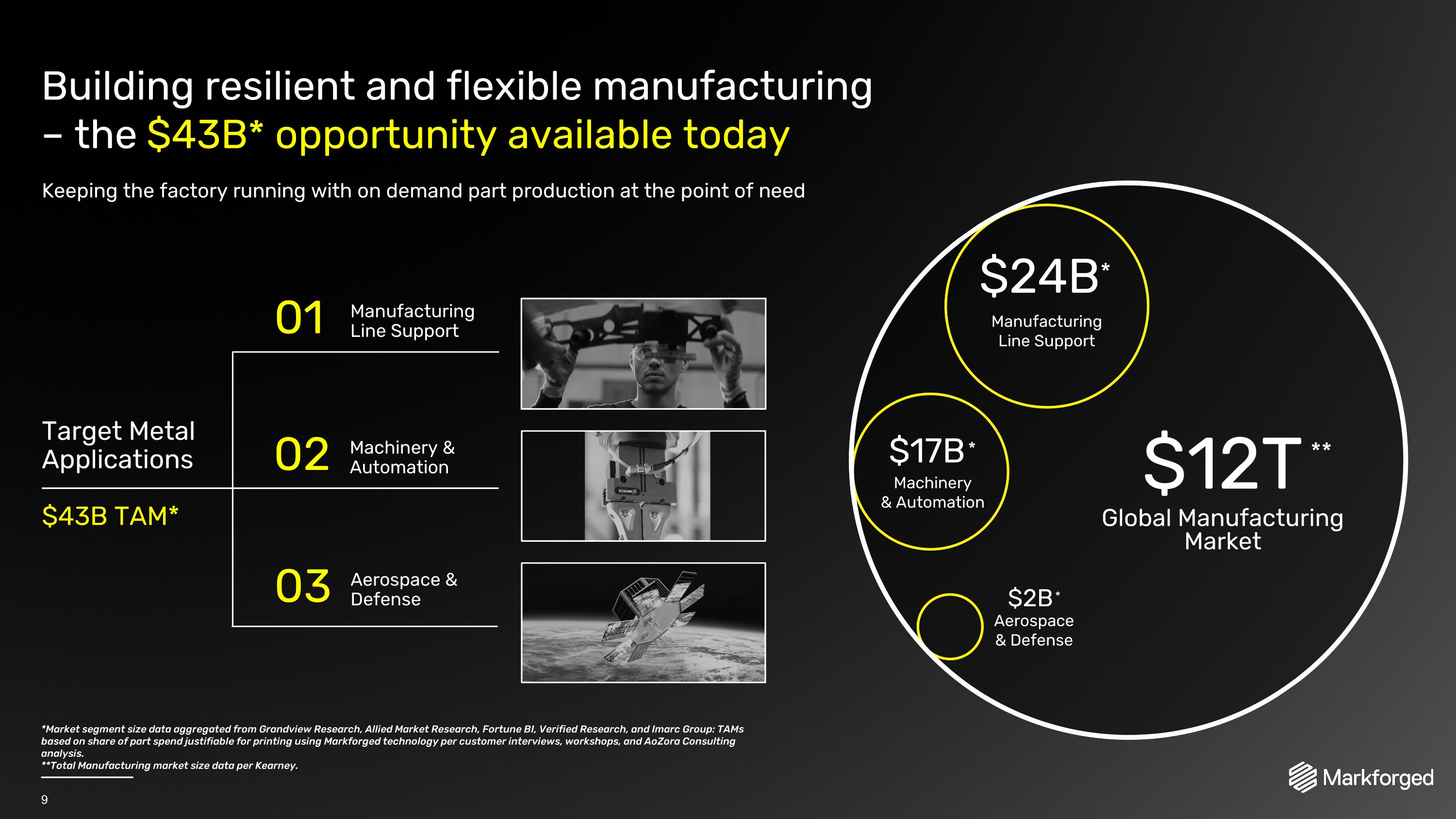

9 Keeping the factory running with on demand part production at the point of need *Market segment size data aggregated from Grandview Research, Allied Market Research, Fortune BI, Verified Research, and Imarc Group: TAMs based on share of part spend justifiable for printing using Markforged technology per customer interviews, workshops, and AoZora Consulting analysis. **Total Manufacturing market size data per Kearney. Building resilient and flexible manufacturing – the $43B* opportunity available today Machinery & Automation 02 Manufacturing Line Support 01 Aerospace & Defense 03 Target Metal Applications $43B TAM* $12T Global Manufacturing Market $2B Aerospace & Defense $17B Machinery & Automation Manufacturing Line Support $24B * * * **

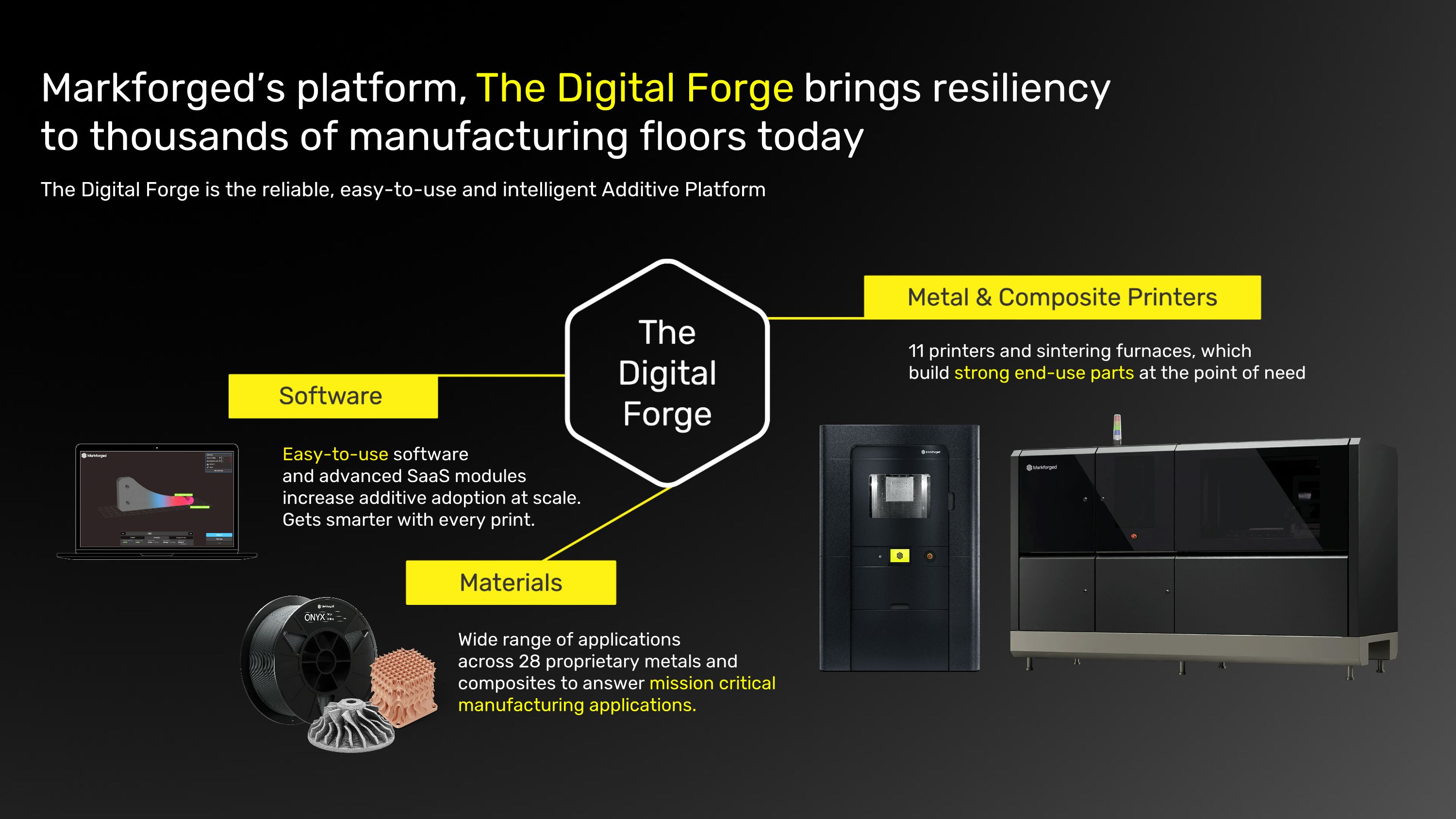

10 Easy-to-use software and advanced SaaS modules increase additive adoption at scale. Gets smarter with every print. Wide range of applications across 28 proprietary metals and composites to answer mission critical manufacturing applications. 11 printers and sintering furnaces, which build strong end-use parts at the point of need Markforged’s platform, The Digital Forge brings resiliency to thousands of manufacturing floors today The Digital Forge is the reliable, easy-to-use and intelligent Additive Platform

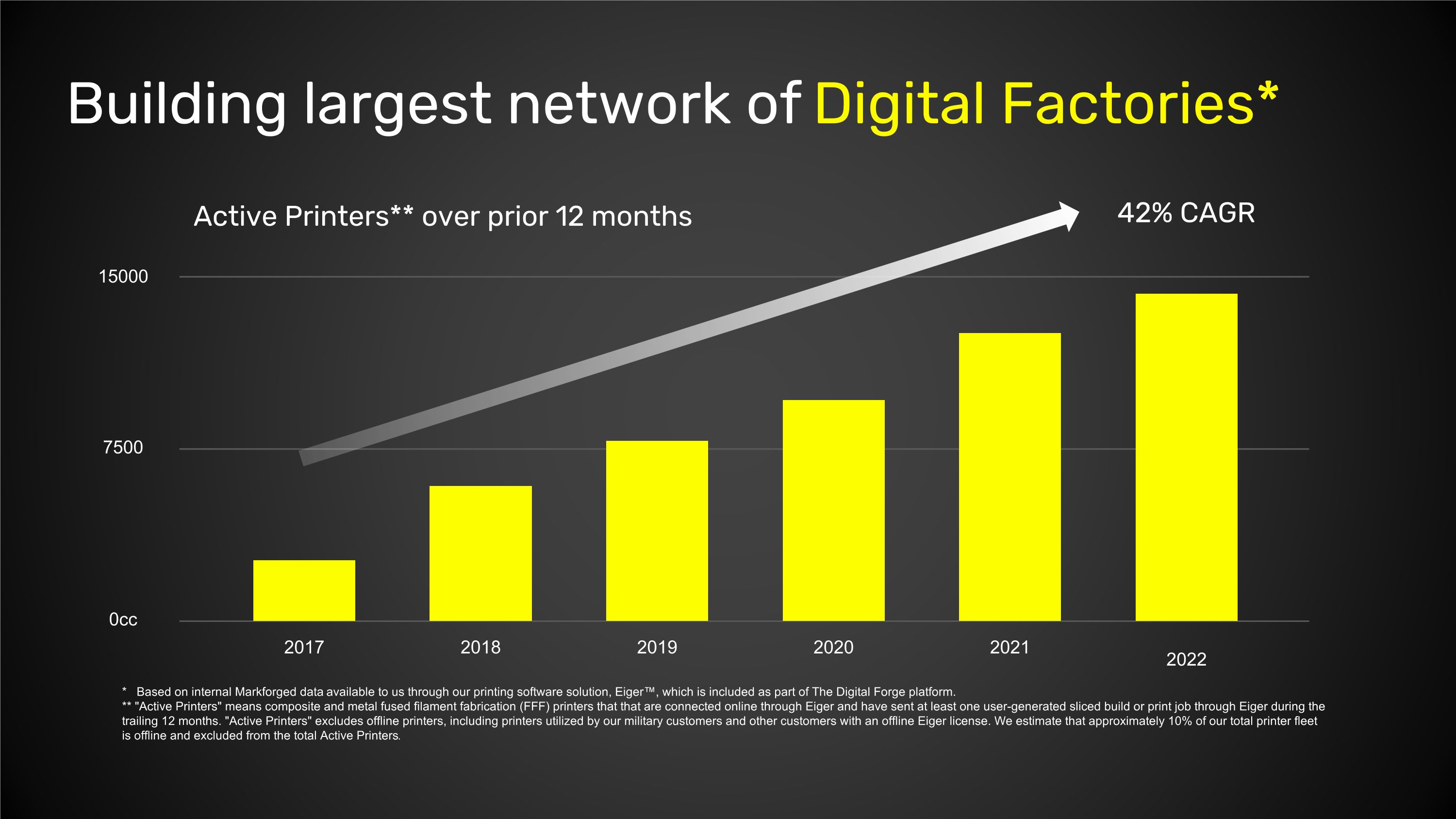

Building largest network of Digital Factories* 2017 2018 2019 2020 2021 2022 7500 15000 0cc 42% CAGR Active Printers** over prior 12 months * Based on internal Markforged data available to us through our printing software solution, Eiger™, which is included as part of The Digital Forge platform. ** "Active Printers" means composite and metal fused filament fabrication (FFF) printers that that are connected online through Eiger and have sent at least one user-generated sliced build or print job through Eiger during the trailing 12 months. "Active Printers" excludes offline printers, including printers utilized by our military customers and other customers with an offline Eiger license. We estimate that approximately 10% of our total printer fleet is offline and excluded from the total Active Printers.

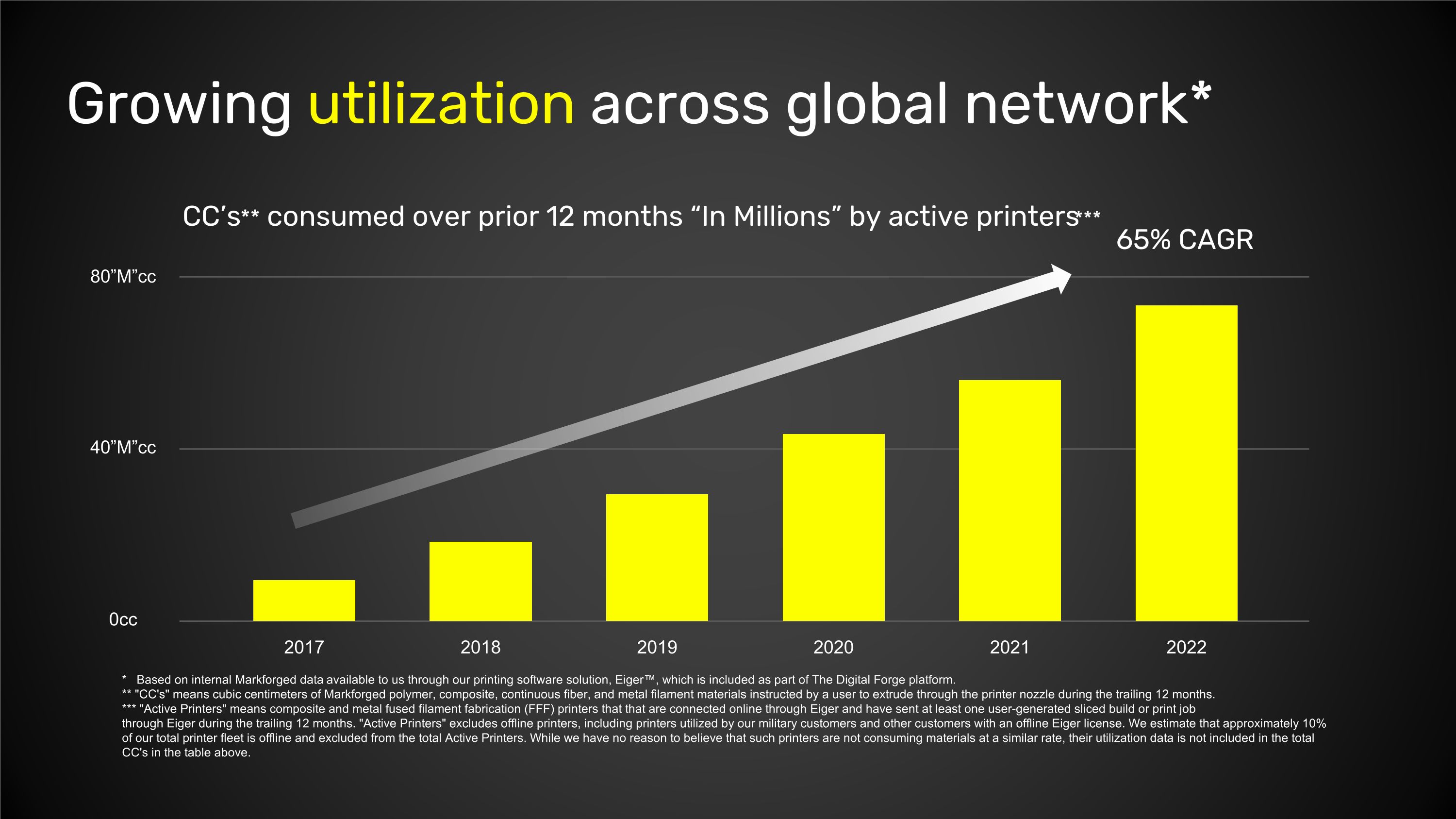

Growing utilization across global network* 2017 2018 2019 2020 2021 2022 40”M”cc 80”M”cc 0cc CC’s** consumed over prior 12 months “In Millions” by active printers*** 65% CAGR * Based on internal Markforged data available to us through our printing software solution, Eiger™, which is included as part of The Digital Forge platform. ** "CC's" means cubic centimeters of Markforged polymer, composite, continuous fiber, and metal filament materials instructed by a user to extrude through the printer nozzle during the trailing 12 months. *** "Active Printers" means composite and metal fused filament fabrication (FFF) printers that that are connected online through Eiger and have sent at least one user-generated sliced build or print job through Eiger during the trailing 12 months. "Active Printers" excludes offline printers, including printers utilized by our military customers and other customers with an offline Eiger license. We estimate that approximately 10% of our total printer fleet is offline and excluded from the total Active Printers. While we have no reason to believe that such printers are not consuming materials at a similar rate, their utilization data is not included in the total CC's in the table above.

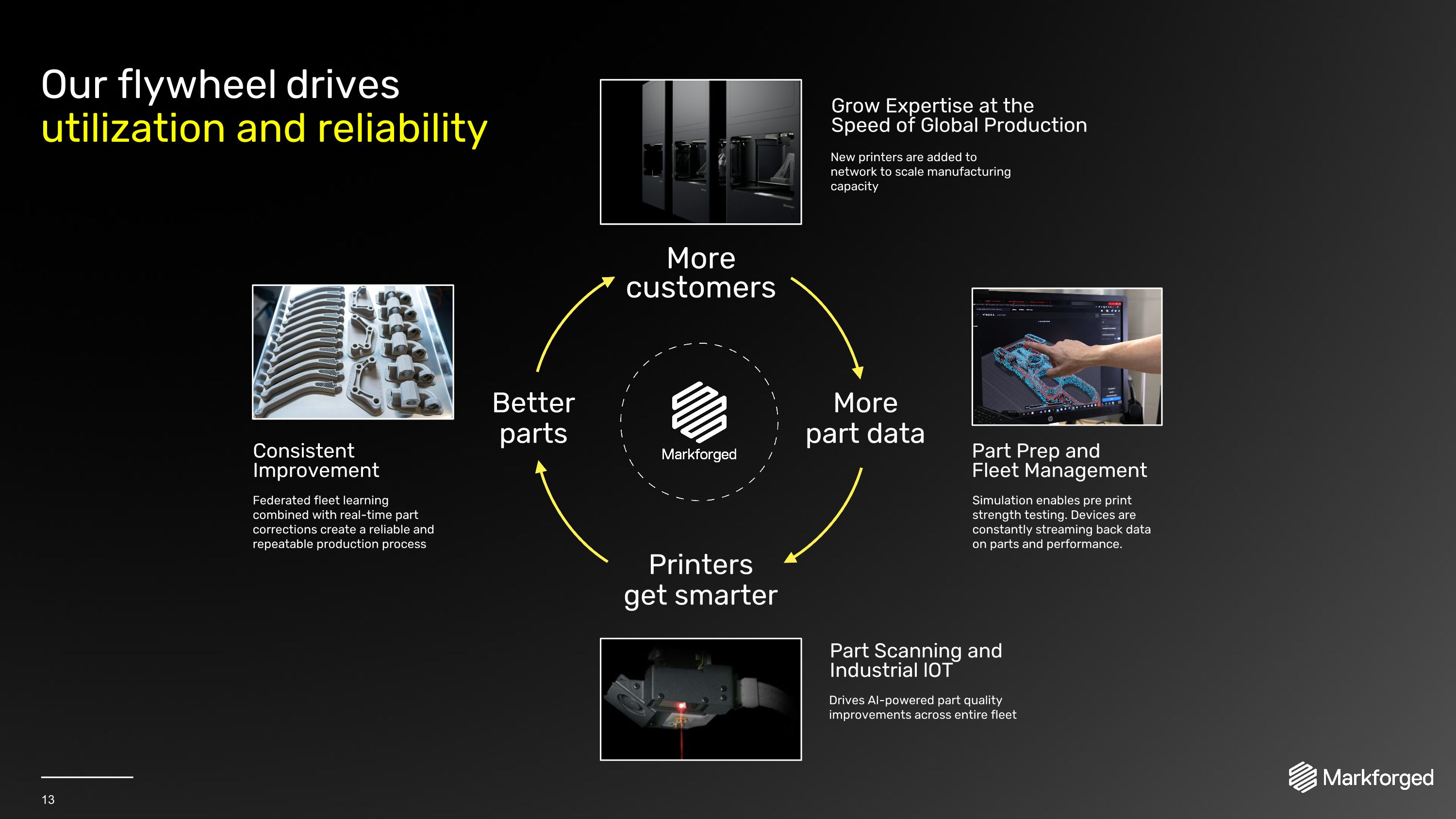

13 More customers Better parts Printers get smarter More part data Part Prep and Fleet Management Part Scanning and Industrial lOT Grow Expertise at the Speed of Global Production Consistent Improvement Our flywheel drives utilization and reliability Federated fleet learning combined with real-time part corrections create a reliable and repeatable production process New printers are added to network to scale manufacturing capacity Simulation enables pre print strength testing. Devices are constantly streaming back data on parts and performance. Drives AI-powered part quality improvements across entire fleet

14 New Innovation Powers Our Future Growth FX20 PX100 Digital Source COMING SOON

15 Markforged is positioned for Rapid Growth. Expanding Product Portfolio Increasing Recurring Revenue Streams Strong Global Team Scalable 100+ Partner Network Robust Balance Sheet

16 05 Customer Panel Rustin Dring, President of Americas

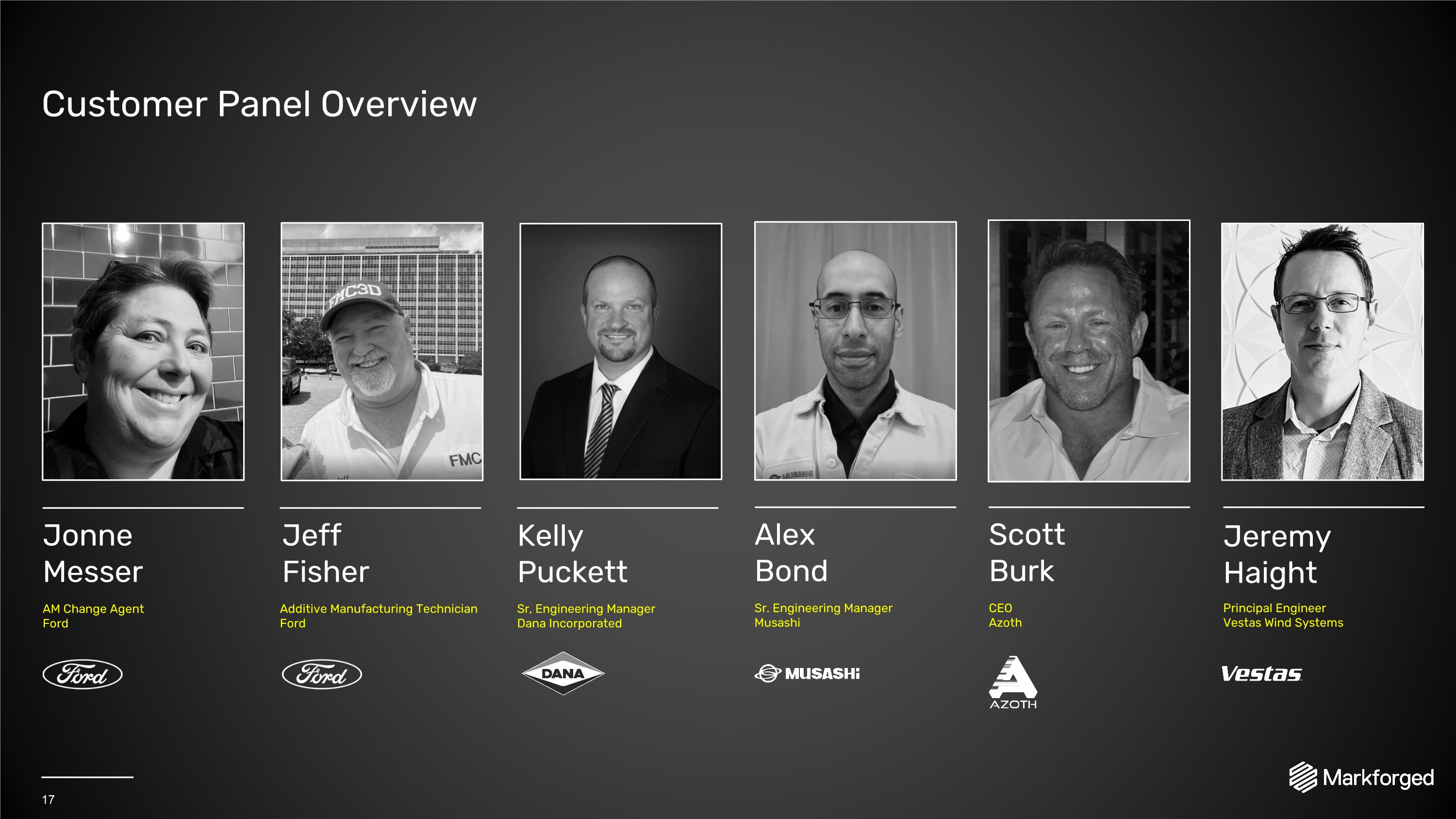

17 Customer Panel Overview Jonne Messer AM Change Agent Ford Principal Engineer Vestas Wind Systems Scott Burk CEO Azoth Alex Bond Sr. Engineering Manager Musashi Jeremy Haight Kelly Puckett Sr, Engineering Manager Dana Incorporated Jeff Fisher Additive Manufacturing Technician Ford

18 05 Introduction to Digital Source Shai Terem, CEO Markforged

19 An on demand platform for 3D printing OEM certified parts, when and where they’re needed.

20

Markforged is building iTunes for manufacturing. 21 Millions of spare parts on your factory floor. From thousands of songs in your pocket to…

22 Why didn’t digital music take off before iTunes? “Ripping” and burning MP3s was too difficult for wide adoption Risk of corrupt files, malware from download sites No business model for music labels

23 Apple transformed digital music. Integration of hardware, software, and content provides the user experience for wide scale adoption. Best Hardware Intuitive Software Mass Adoption User Experience IP Security Attractive Financial Model Embraced by Music Labels MENU

24 Markforged has the opportunity to lead the future of distributed manufacturing.

25 Why hasn't digital inventory taken off before now? Inconsistent part quality creates OEM reputation risk Too complex for adoption on the factory floor Insufficient protection for OEM intellectual property

26 The Digital Forge provides the strength, simplicity and reliability to support widespread factory adoption Markforged intends to transform digital inventory. IP Security Attractive Financial Model Embraced by OEMs Premium Hardware Cloud Software “Just Press Print” factory floor experience Industrial Materials

27 Markforged Customers OEM Designers Pay-per-print revenue stream Printer and materials demand Faster adoption of distributed manufacturing Shorter lead times Lower cost parts Less inventory overhead High margin revenue stream Brand and IP security Simplified supply chain Digital Source offers value across the board.

28 05 How it Works Digital Source Tripp Burd, New Platforms Director

Digital Source Case Study: BMF GmbH 29 German manufacturer of sandblasting machines Hundreds of units in factories around the world Dozens of printed parts per machine Digital Source is designed to improve customer experience and accelerate demand for the Digital Forge.

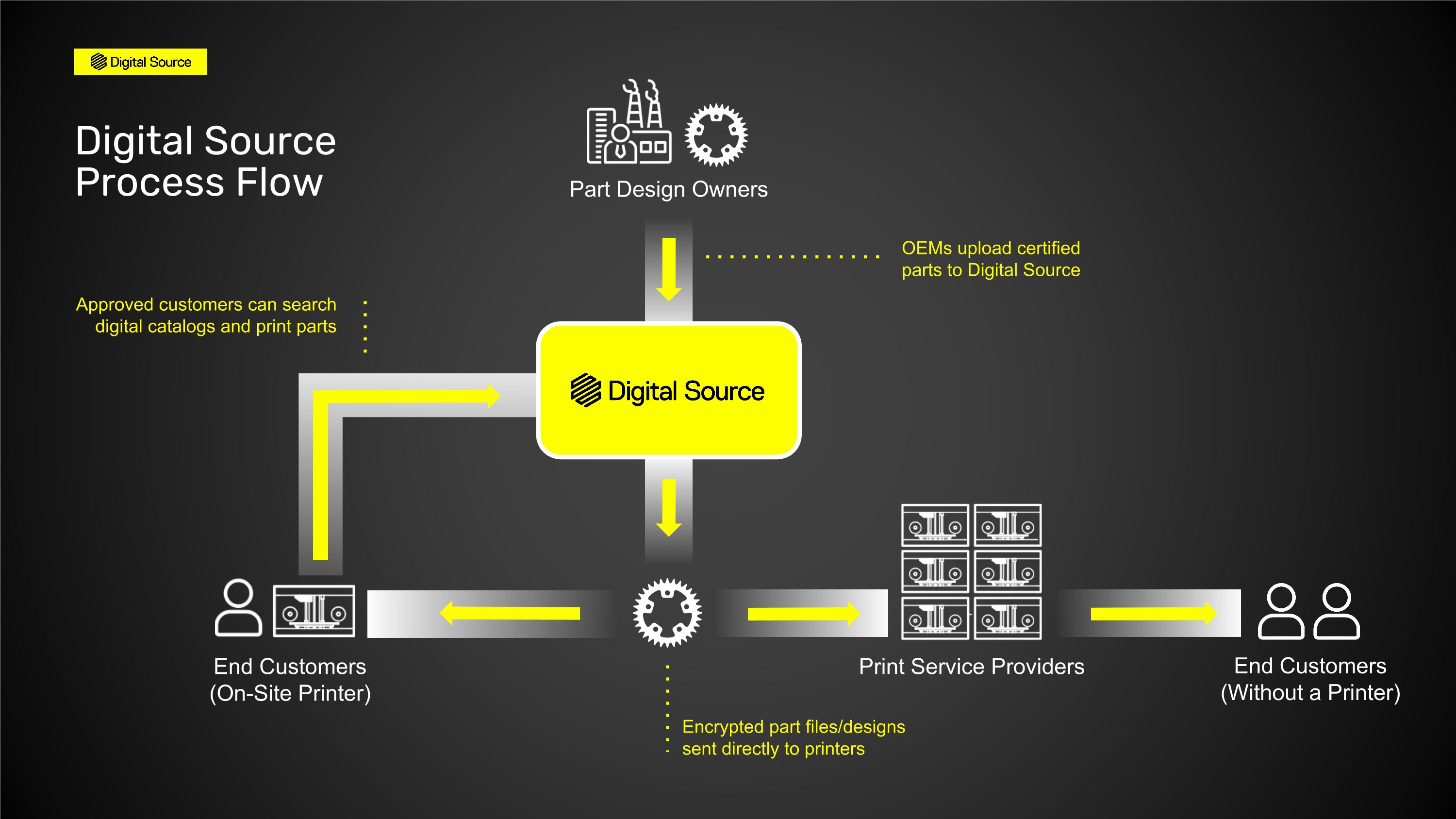

OEMs upload certified parts to Digital Source Encrypted part files/designs sent directly to printers End Customers (On-Site Printer) Part Design Owners Approved customers can search digital catalogs and print parts End Customers (Without a Printer) Digital Source Process Flow Print Service Providers

32 Multiple use cases for Digital Source

33 Production MRO Line retooling from automotive system integrators Spare parts for packaging equipment Automation parts for warehousing Continuous improvement jigs and fixtures Inventory for offshore energy installations

34 Product Distribution Automotive OEM parts to dealer network Consumer parts to global distributors CNC accessories to customer base

35 Manufacturing Partnerships Aerospace engine overhaul tooling to service centers Markforged quality control gauges to CMs AM Center of Excellence to branch locations

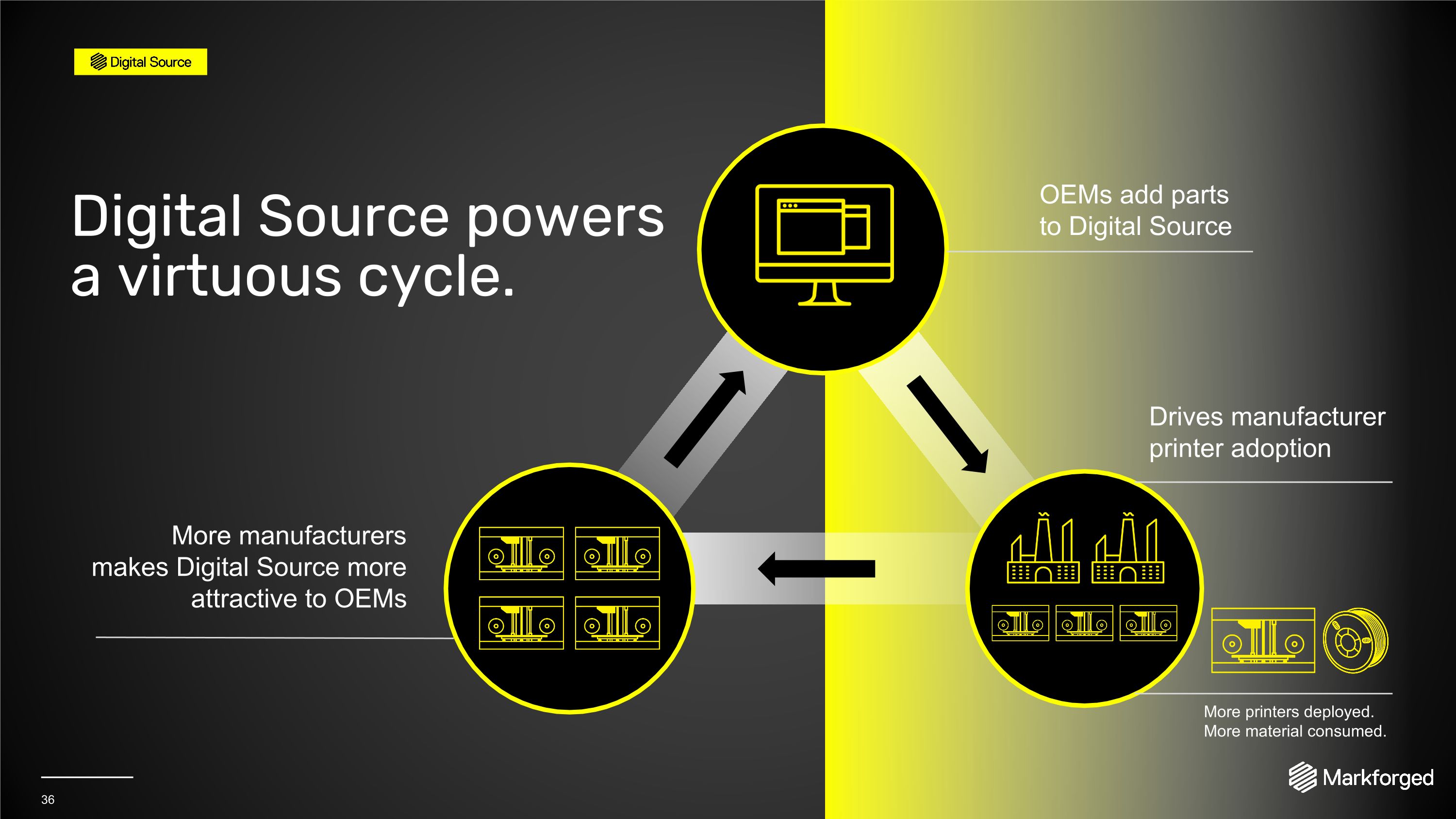

36 OEMs add parts to Digital Source More printers deployed. More material consumed. Drives manufacturer printer adoption More manufacturers makes Digital Source more attractive to OEMs Digital Source powers a virtuous cycle.

37 Large Market Opportunity $12T Global Manufacturing Market $49B MRO by 2030 MRO for manufacturing industry anticipated to reach $49.65B by 2030* * MRO Market for the Manufacturing Industry by Meticulous Research

38 Opportunity for High Margin Recurring Revenue Streams Digital Transformation Pay Per Print Product Expansion

39 14,000+ active printers. 5,500+ factory locations across the world.

We’re not building a network — We’re turning one on. 40

06 Digital Source Customer Panel 41 Pavan Muzumdar COO Automation Alley Principal Engineer Vestas Wind Systems Jeremy Haight

42 07 Financial Update Assaf Zipori, Acting Chief Financial Officer

43 Executing on plan towards 2023 targets.

44 Revenue & Gross Margin Demand for The Digital Forge continues to grow globally despite a challenging cap ex environment . 1H23 **$50M **$101-110M 2023 1H23 *49% 2023 *47-49% *We currently intend that non-GAAP reporting will exclude share-based compensation, amortization, other income, and other non-recurring, unusual and infrequent charges from our GAAP results. **2023 Revenue guidance is on a GAAP basis. As provided in the Company’s second quarter and year earnings conference call on August 10, 2023. Reiterating 2023 Targets

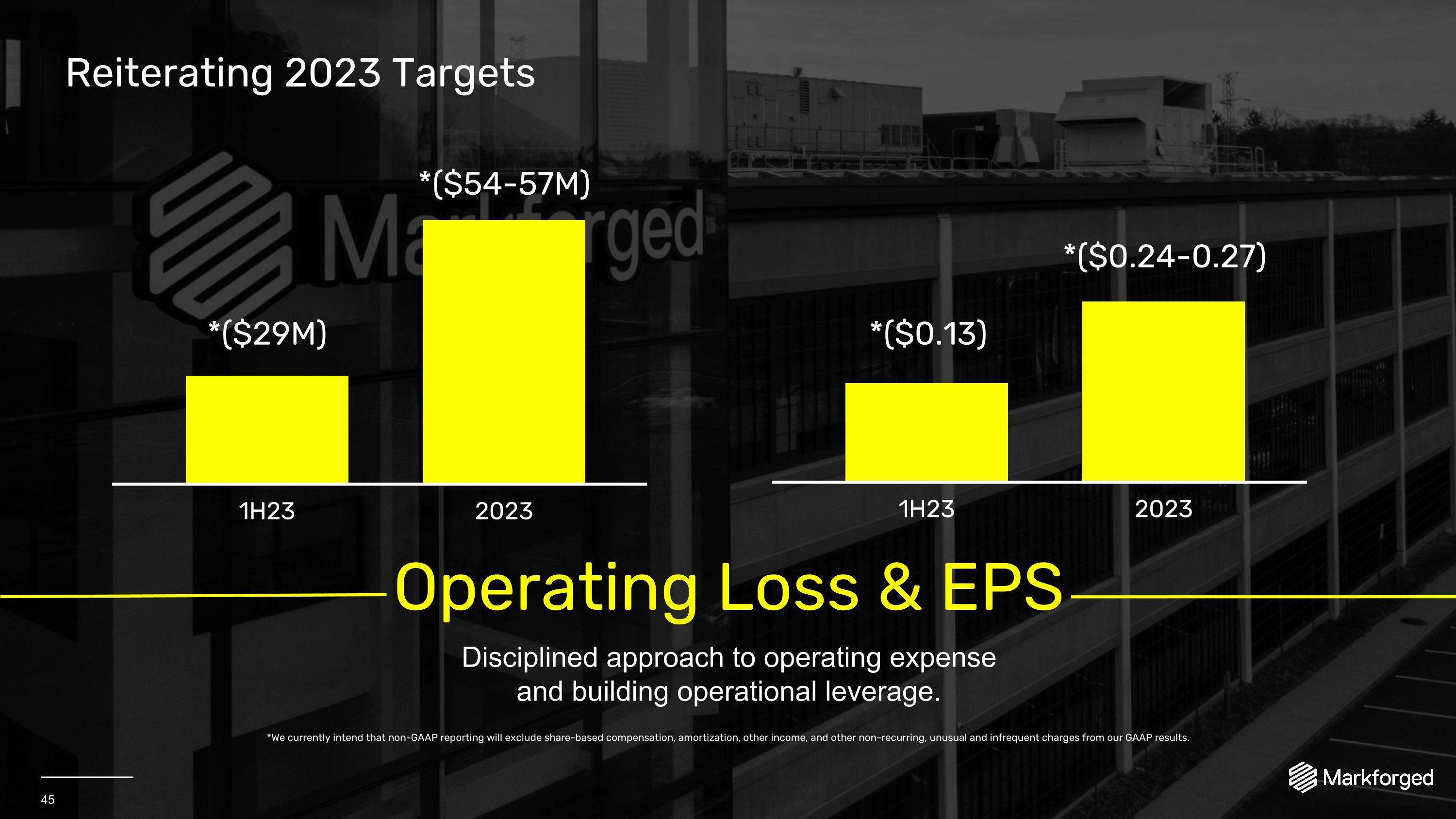

45 Operating Loss & EPS Disciplined approach to operating expense and building operational leverage. 1H23 *($29M) *($54-57M) 2023 1H23 *($0.13) 2023 *($0.24-0.27) *We currently intend that non-GAAP reporting will exclude share-based compensation, amortization, other income, and other non-recurring, unusual and infrequent charges from our GAAP results. Reiterating 2023 Targets

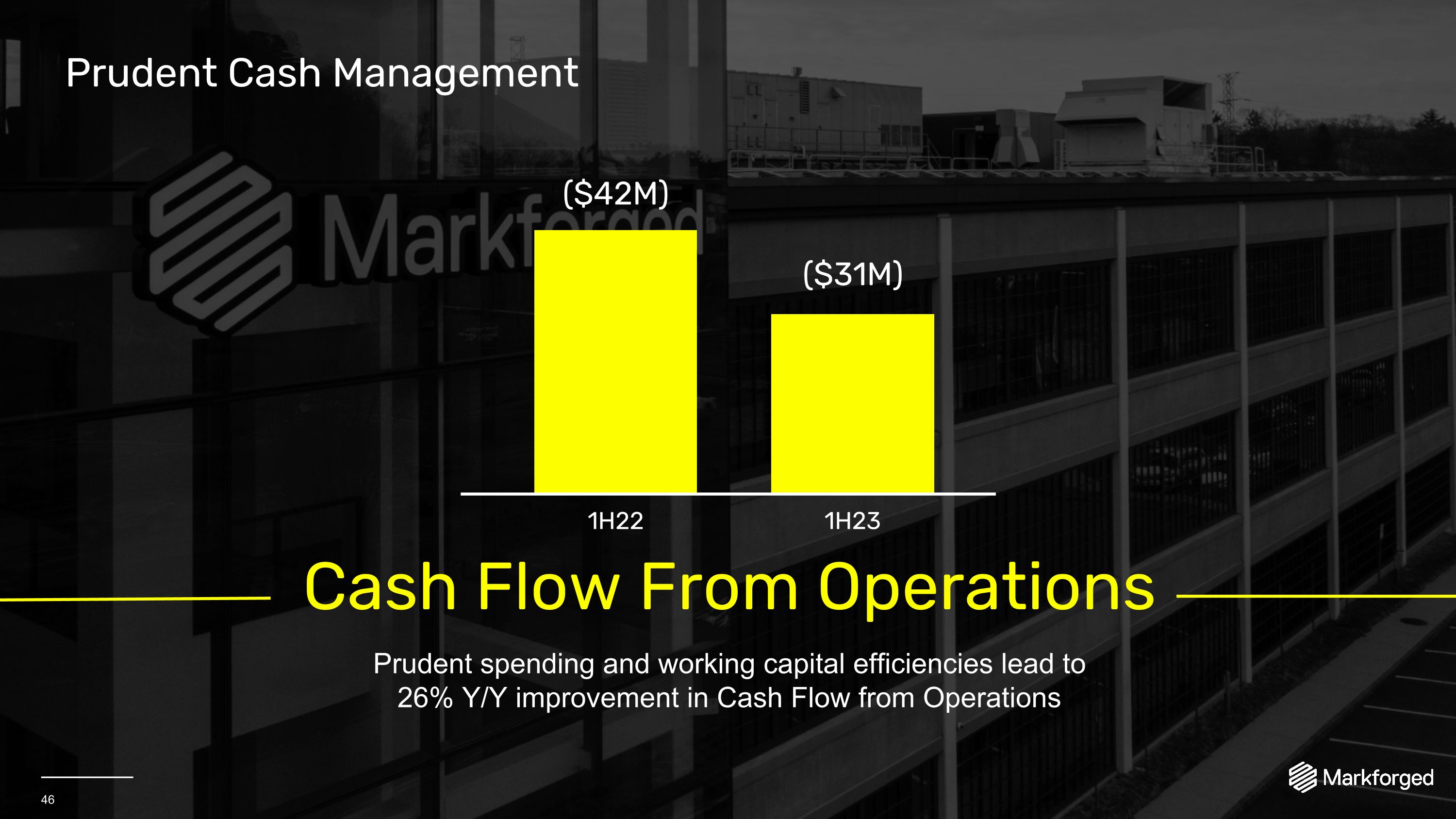

46 Cash Flow From Operations Prudent spending and working capital efficiencies lead to 26% Y/Y improvement in Cash Flow from Operations 1H22 ($42M) ($31M) 1H23 Prudent Cash Management

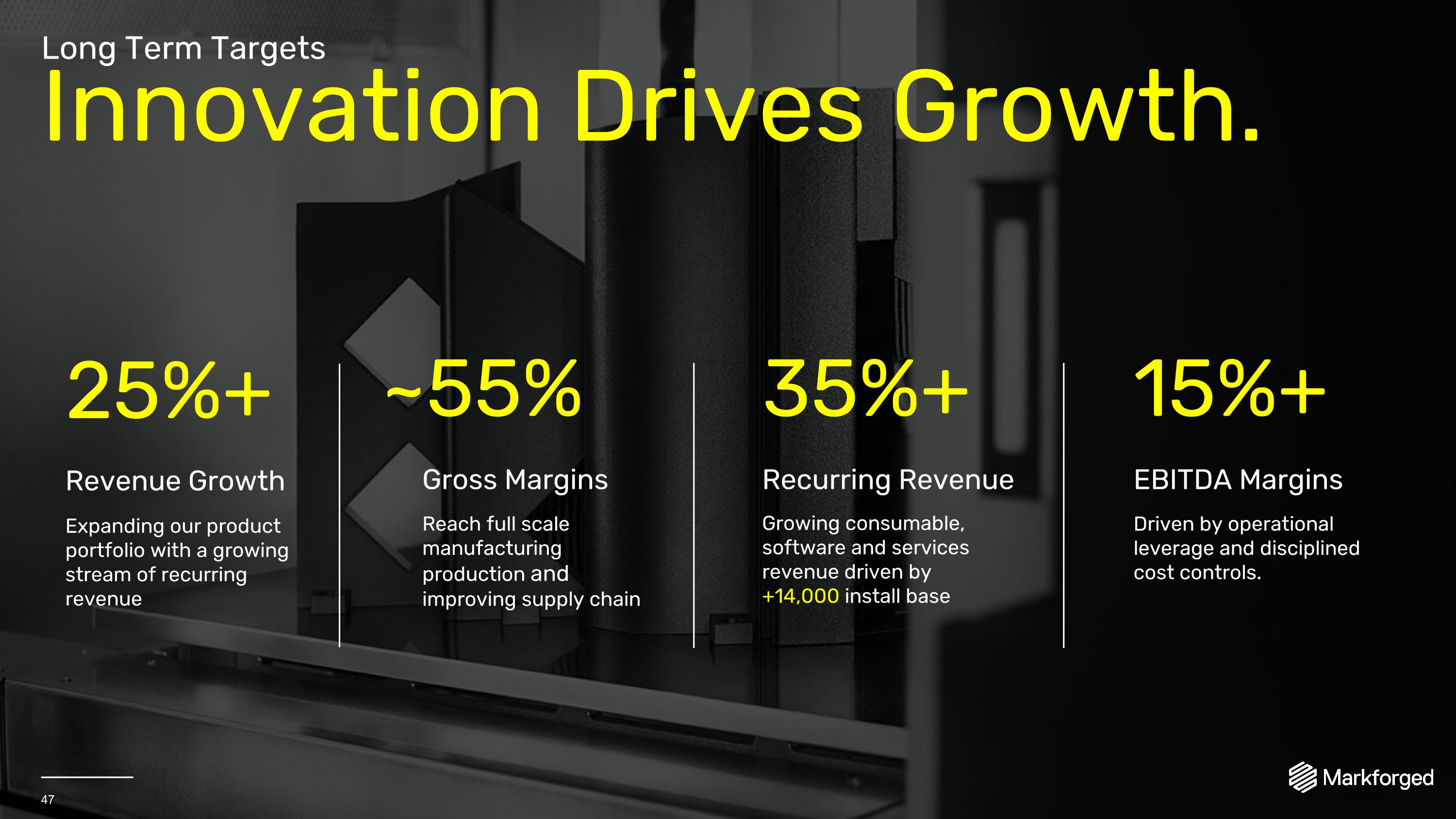

47 Long Term Targets Innovation Drives Growth. Revenue Growth Gross Margins 25%+ ~55% 35%+ Growing consumable, software and services revenue driven by +14,000 install base Recurring Revenue Reach full scale manufacturing production and improving supply chain Expanding our product portfolio with a growing stream of recurring revenue 15%+ Driven by operational leverage and disciplined cost controls. EBITDA Margins

48 The Inflection Point is Here. Increasing utilization across 14,000+ printer network Expanding addressable market through FX20 and PX100 Accelerating adoption through Digital Source Robust new product pipeline

08 Q&A 49

09 Appendix 50

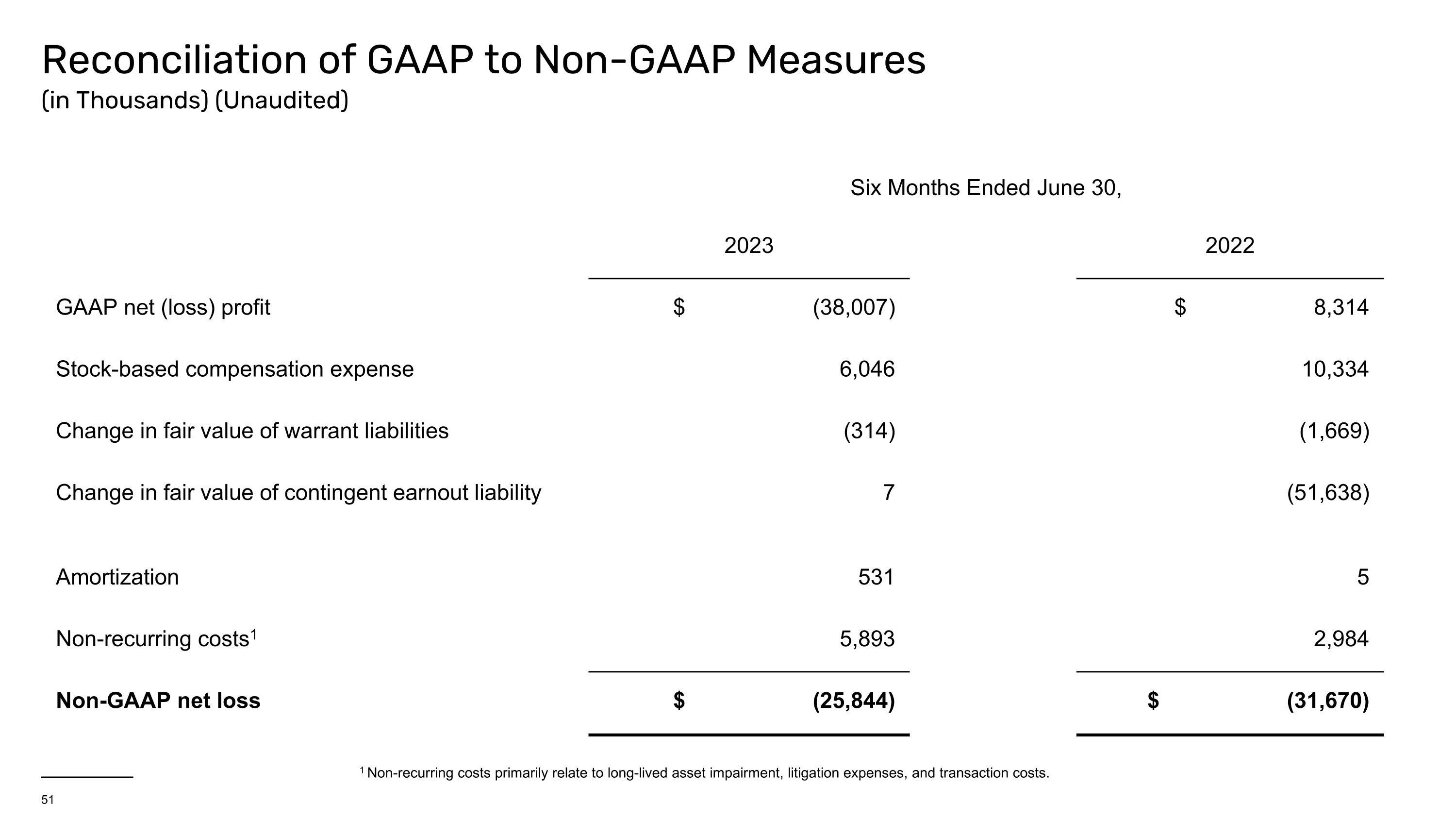

51 Reconciliation of GAAP to Non-GAAP Measures (in Thousands) (Unaudited) Six Months Ended June 30, 2023 2022 GAAP net (loss) profit $ (38,007) $ 8,314 Stock-based compensation expense 6,046 10,334 Change in fair value of warrant liabilities (314) (1,669) Change in fair value of contingent earnout liability 7 (51,638) Amortization 531 5 Non-recurring costs1 5,893 2,984 Non-GAAP net loss $ (25,844) $ (31,670) 1 Non-recurring costs primarily relate to long-lived asset impairment, litigation expenses, and transaction costs.

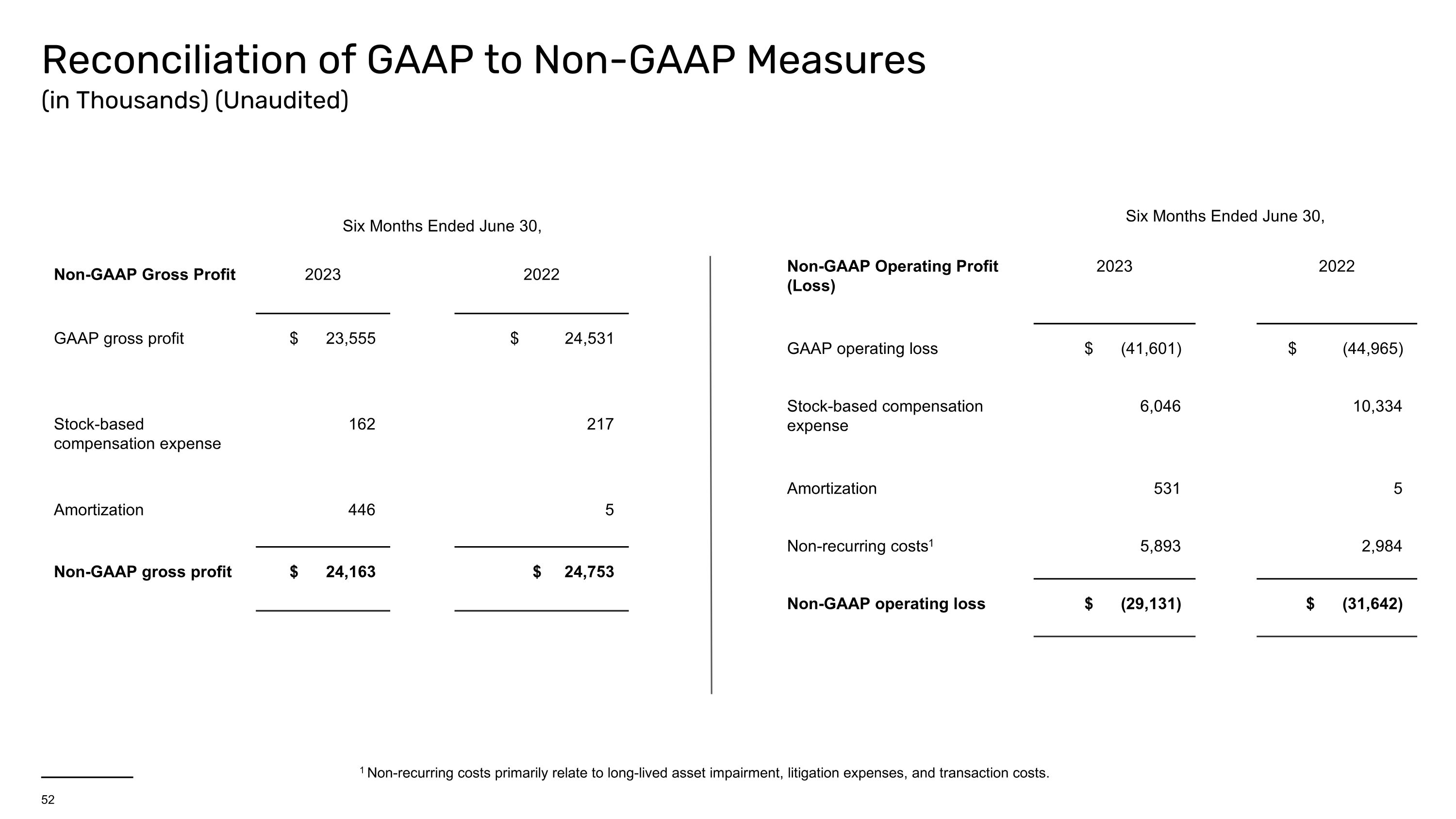

52 Reconciliation of GAAP to Non-GAAP Measures (in Thousands) (Unaudited) Six Months Ended June 30, Non-GAAP Gross Profit 2023 2022 GAAP gross profit $ 23,555 $ 24,531 Stock-based compensation expense 162 217 Amortization 446 5 Non-GAAP gross profit $ 24,163 $ 24,753 Six Months Ended June 30, Non-GAAP Operating Profit (Loss) 2023 2022 GAAP operating loss $ (41,601) $ (44,965) Stock-based compensation expense 6,046 10,334 Amortization 531 5 Non-recurring costs1 5,893 2,984 Non-GAAP operating loss $ (29,131) $ (31,642) 1 Non-recurring costs primarily relate to long-lived asset impairment, litigation expenses, and transaction costs.